Digital money, like real money, cannot appear out of nowhere, even though there is no central issuing authority responsible for their issuance. So where do they come from? Let’s understand the essence of cryptocurrency mining and how to earn on it.

Despite sharp rises or falls in the exchange rate, news about wallet and exchange hacks do not lose their investment appeal. To engage in trading, a good theoretical background and the ability to keep calm when a deal goes in the red are required. To preserve nerves, you can take another path: engage in mining (English: mining, extraction) or creating new digital coins. What is it and how to make money on it — read in our article.

The main task is to find the next unique hash key (block), which is then added to the transaction, confirming its validity and the absence of double spending. How this is done from a mathematical point of view can be found on the Internet; here we will only answer the main points of what cryptocurrency mining is about, without requiring special knowledge.

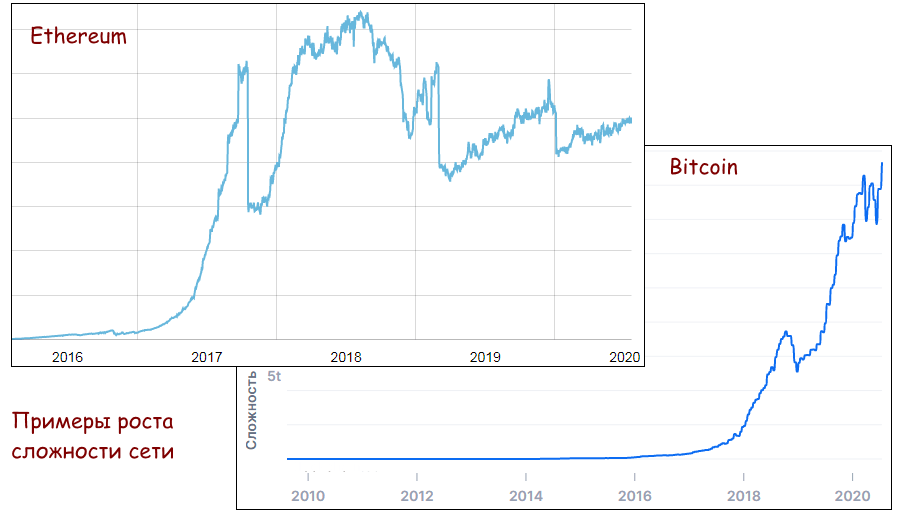

After finding and confirming a new block, the miner receives a reward, and the network difficulty increases. According to Bitcoin creator Satoshi Nakamoto — this should prevent a sharp increase in new coins and avoid “internal” inflation of digital currencies. As of July 2020, the Bitcoin block reward is 6.25 BTC, Ethereum (ETH) — 2 ETH.

In simple words, this means that to make a profit, you need to constantly increase the hardware power, and there may come a moment when the market price of the coin will not cover the overhead costs of mining. An alternative can be coins where the network difficulty is still low or coins that operate on the premine model, where all coins are issued in advance, and “mining” involves receiving rewards for confirming transactions.

Selecting a currency for mining

Digital currencies are classified by the type of encryption algorithm, whose complexity determines the hardware configuration. The most widespread options are:

- SHA256. Used by Bitcoin and all its soft and hard forks (Bitcoin Cash, Bitcoin Gold, etc.);

- ETHASH. Used in Ethereum (ETH), the second-largest and most valuable cryptocurrency;

- Scrypt. Appeared in Litecoin and is an extension of SHA256. Also available on Scrypt ASIC devices.

- CryptoNight. Used in MONERO and provides increased user and transaction anonymity. Suitable for beginners with a limited budget.

The rest do not significantly influence the market; they are mainly used for pre-mining or are mined on equipment based on the above algorithms. Now, let’s move on to methods and types of “farms” for mining cryptocurrencies.

Starting with the Central Processing Unit (CPU

The first Bitcoin and the first “clone” Litecoin were mined using personal computer processors. Back when cryptocurrencies were known only to a narrow circle of enthusiasts, network complexity grew slowly and didn’t require serious investments. Times have changed, but for “beginners,” this is the best way to get acquainted with mining:

- The process can run entirely on a computer or through a browser connected to a specialized service such as ZergPool. Then the personal computer becomes part of a distributed computing network and resembles a cloud pool (see “Cloud Mining” below), but the speed and rewards are lower.

- Choose currencies with low complexity or where CPU is a priority. For example, Bitcoin and its fork MONERO, whose algorithm is constantly complicated to prevent implementation on microchips (see “ASIC miners” below). Even in 2020, it is quite possible to mine coins in a reasonable time using multi-core i-CORE 5/7 with at least 8GB RAM.

Mining faster with NVidia and AMD Radeon graphics cards

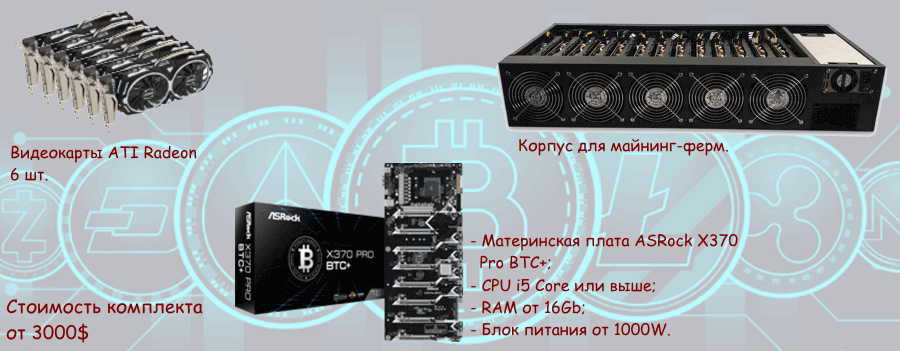

After cryptocurrency algorithms became publicly available, it turned out that graphics card processors (GPU) can not only render game frames but also calculate hashes of new blocks, significantly outpacing CPUs. Starting from 2016, farms based on GPUs dominated, especially since Bitcoin difficulty was not very high. Even now, graphics cards allow mining Ethereum and many other currencies from the TOP-20 by capitalization and value, even with modest profitability. Example of a starter kit for AMD components (actual device photos may vary):

The operating system can be standard Windows or Linux-based, such as EthOS for Ethereum (ETH). Motherboards are available for NVidia and ATI Radeon with different port counts (up to 14 on one board), and other components do not have strict specifications. You can use a special case or make a stand yourself, etc. When analyzing GPU mining, remember the main principle:

The speed of finding a new block depends only on the GPU’s performance, the amount of memory (which must be at least as large as the key being checked), and their quantity. Other characteristics like motherboard, CPU speed, and RAM are secondary, although they shouldn’t be very old.

The main problem requiring separate solutions is the increased heat generated, common in multi-processor and “multi-card” systems. Ignoring this leads to wiring fires or melted homemade stands. It’s impossible to fully solve, but you can use several case fans or open stands.

At peak popularity, original solutions included using the heat generated for heating rooms. For example, the Russian company Comino offered a farm that used liquid cooling to heat premises. Similar devices are still available in Chinese online electronics stores.

Always look for cheap electricity; otherwise, profit margins will drop significantly. Many countries, including Russia, are developing programs for cheap tariffs for miners. Keep an eye on the situation and switch providers in time!

ASIC mining — moving to the top league

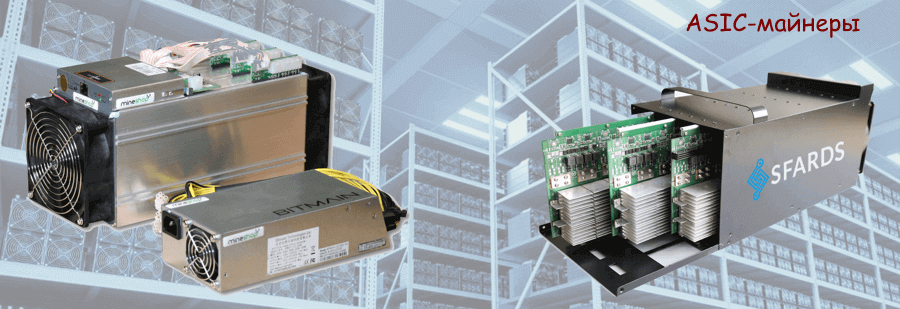

Processor frequency and memory volume constantly increase, but digital money are primarily designed for graphics display. The ever-growing network complexity has made them unprofitable for market leaders; since 2012-2013, Bitcoin has become economically unviable for them. At that time, specialized devices called ASICs were developed, designed for only one function — finding new blocks. Their performance increased sharply, and overhead costs decreased: ASIC miners are more compact, consume less electricity, and generate less heat.

The trade-off is high cost (from $2,000–$3,000), but if the coin is chosen correctly and the market situation is favorable, an ASIC can become profitable in 4-5 months. Use a mining calculator for calculations to avoid unnecessary expenses at the start.

Saving with cloud pools

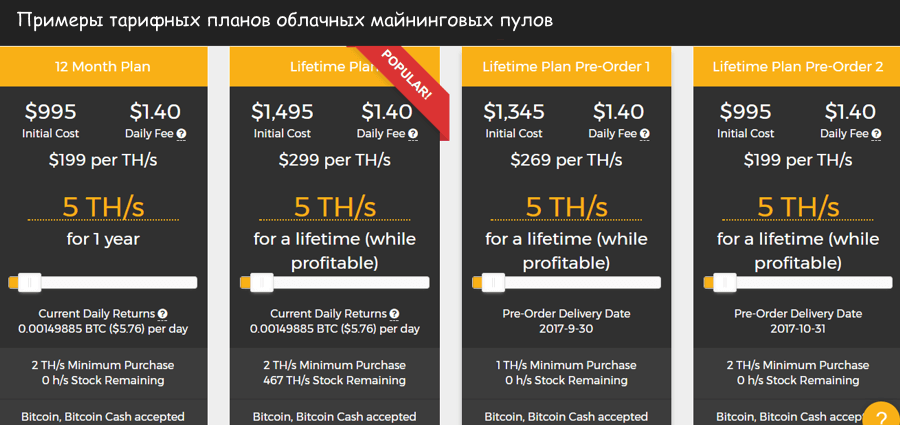

If you don’t have the money for an ASIC or enough graphics cards, joining cloud mining pools can help. It’s enough to buy a part of their computational power, measured in hashes (how many keys are checked for uniqueness per second), and then receive your share of each new block.

The principle is simple — the more purchased speed, the more significant the “contribution” in finding a block, and thus the higher the reward.

Besides these methods, there are exotic options for mining, but relying on real income in cryptocurrency is not worth it. It’s more entertainment than a main activity:

- on hard drives (HDDs). Blocks of hash options are written directly to the disk, then checked for uniqueness. The mining program receives a new batch of information simultaneously with other network participants, and the first to confirm uniqueness gets the reward. If none do, a new batch of keys is loaded. The more space allocated for new hashes, the higher the chance of being first. It’s recommended to run disks 24/7, although this increases errors and data gaps as the surface wears out! Currently, only three currencies are available: Burstcoin (BURNST), Storj (STJ), and SiaCoin (SC).

- on mobile devices running Android or iOS. The computing power of modern smartphones and tablets theoretically allows starting the mining process. Here are some examples of devices where MONERO or ZCash mining algorithms can run.

Results are disappointing: despite processor gigahertz and gigabytes of memory, mobile devices are far inferior to PC processors and HDDs. Moreover, their components are not designed for round-the-clock operation at full capacity; overheating is an even more serious problem than with GPUs. However, if you want to learn how mining works, it’s a quite affordable and acceptable option.

Periodic announcements of “blockchain phones” have nothing to do with mining. They are simply centralized, unchangeable storage for confidential information and encrypted messengers.

- Through a browser. Everything happens without investments: just open the webpage, enter your wallet address for payouts, and the browser does the rest. Results are similar to those on smartphones, with the same security issues — unknown code runs on the computer.

Mining extensions can be secretly installed in browsers, so don’t neglect antivirus software and regularly monitor your computer’s load. Don’t waste your resources on other people’s coins!

So, we’ve examined what cryptocurrency mining is about and can answer the main question — can you make money on it? Yes, but what are the investments needed for the profit to have real “weight”? Market leaders require large initial investments, and whether they pay off or not — even Bitcoin, whose price can change by 15-20% in a day, doesn’t know. Moreover, the reward for a new block has halved. It’s always a personal decision, but it’s better to focus on trading and earn more with less investment. Nowadays, it’s easy to do this not only with Forex brokers or crypto exchanges but even on binary options.