Everyone knows that money should work and generate profit. Ideally, with minimal effort from the investor, by diversifying across multiple assets. The interest rates on bank deposits, although not requiring constant attention, do not keep up with inflation rates, especially in the former USSR territories. Currency and stock markets offer the opportunity to earn more if you have experience and capital. There is also a worthy alternative – investments in cryptocurrency funds.

This article discusses only passive investment options in specialized funds, unlike active investments where digital coins are purchased on exchanges or through exchange offices with subsequent sales at higher prices. When to do this, the investor decides himself, and without trading experience, it always leads to losses. Moreover, promising ICO projects may be more profitable in medium- and long-term perspectives than exchanges. But the criteria for selection are complicated, and it’s better to consult professionals.

Where Funds Invest

If the choice is trading on exchanges, currently there is only one instrument that has all the properties of securities, including guarantees and clear legal regulation – Bitcoin futures listed on the Chicago Mercantile Exchange (CME). Trading started in December 2017, and so far, no other cryptocurrencies are available, nor are they expected. Even in Japan, where digital money is officially recognized as a payment method, stock exchanges are reluctant to include them in their listings. Therefore, funds have to operate only through crypto exchanges: from offshore ones that are almost impossible to control (YoBit, EXMO), to those operating within legal frameworks but with restrictions for certain regions (Bitfinex, Kraken, Coinbase).

Cryptocurrency funds also widely use investments in ICO projects. The main problem with such investments is the constant change in regulators’ “moods”. For example, in the USA, they must be registered as securities, while China has completely banned ICOs. Both options do not contribute to reducing risks and increasing market transparency. On the one hand, mandatory registration with the SEC (U.S. Securities and Exchange Commission) helps eliminate obviously fraudulent projects, but on the other hand, the complete ban in China caused a sharp outflow of funds to offshore zones. All this complicates the search for truly profitable tokens, and without professional analysts’ opinions, it’s impossible to navigate.

Regulation and Investors’ Rights

In simple terms, the legal status of a cryptocurrency fund for any jurisdiction is divided into two main sections: general regulation of the digital money market and the specific investment companies. Currencies can be completely prohibited or restricted locally. For example, in the EU, coins declared to have real backing (stablecoins) cannot be used, and in Russia, cryptocurrencies can be owned and mined without using them as a payment method. All these factors directly influence the fund’s methods of operation and its final results.

The optimal option is when a crypto fund is organized according to the scheme of a traditional mutual fund (PIF) with corresponding licenses. Investors receive a share (unit) of the fund’s capitalization. It can be fixed (in money), or percentage-based (changing depending on current activity). PIFs can be closed or exchange-traded, using not only direct investments but also their own index bonds ETF (Exchange Traded Fund) traded on the exchange along with other assets (stocks, options, futures).

Brokerages can also accept funds from investors and traders for passive income payouts. Usually, these are “successful trader indexes,” which are periodically updated. No responsibility, as with PAMM accounts, is borne by the broker.

Examples of Funds

Despite the ambiguous attitude of regulators, sharp fluctuations in the value of Bitcoin and other top-100 currencies, pandemics, and other force majeure factors, profits from cryptocurrency trading are growing, and naturally, funds are starting to raise initial conditions for new clients. For example, Crypto Fund from Switzerland announced in 2019 that after obtaining all licenses, it would only work with qualified investors, i.e., from one million dollars. This is quite fair for a legally operating fund in such a risky market as cryptocurrencies. But there are good investment options even for smaller investors. Below are just examples of funds; this is not advertising or investment recommendations!

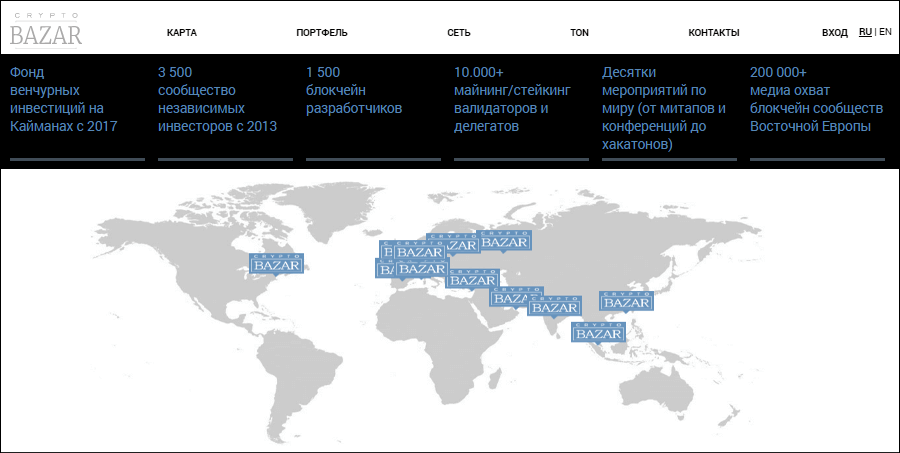

Cryptobazar

An investment fund registered offshore in the Cayman Islands and managed by a group of Russian entrepreneurs. Among the most well-known founders is Alexander Ivanov, creator of the Waves blockchain platform for quick ICO launches.

Most investments are made at the pre-ICO stage, when token distribution occurs in a closed mode among a limited number of investors. This allows obtaining a stake in the company at the lowest price before trading begins on the exchange. One of the most successful deals since its inception in 2017 was with South Korea’s blockchain platform ICON, which brought the fund a 1300% profit compared to the initial token price.

Only one problem: the fund deals with large projects, and the entry threshold for beginners is quite high. To join the selected circle of investors, you need at least $50,000–$100,000 in capital.

Crypto20

The project aims to form and continuously update a ranking of the 20 largest cryptocurrencies and funds for proper asset allocation. Instead of long deliberations on where and how to invest, the client simply needs to acquire the Crypto20 token.

All this resembles stock indices like NASDAQ or Dow Jones, but this is only a superficial similarity. Cryptocurrencies and real economic sectors cannot yet be evaluated by uniform principles, and the authors do not disclose the exact criteria used to calculate Crypto20’s current value. Although current indicators are good, and the fund can be considered for potential investment.

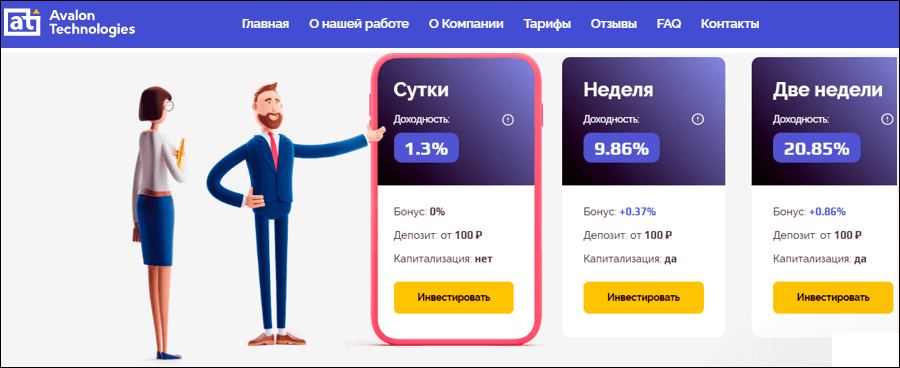

Avalon Technologies

A project with the most controversial reviews on the Internet — from excitement to total negativity, but without it, this overview would be incomplete (not an advertisement). Moreover, Avalon offers everyone a chance to earn, as the initial deposit is only 100 rubles.

Before rejoicing and withdrawing money from the drawer, remember that in all countries with proper financial regulation, promises of specific profits are legally prohibited, as this is one of the main signs of a pyramid scheme. Whether to participate in such schemes is your decision. The only advice is not to invest your last funds, constantly withdraw profits, and leave when the amount reaches the initial investment.

How to Choose the Right Crypto Fund

Follow the main principles of analyzing investment management. First of all, assess the average return over the past 1-2 years, the ratio of borrowed to own funds, and the maximum drawdown level (recommended no more than 25-30%). Also, consider that the current cryptocurrency market is quite liquid and stable, allowing the use of proven technical analysis strategies: from scalping and intraday to medium- and long-term.

Therefore, a truly qualified manager should deliver results comparable to the stock and currency markets, based on the chosen money management system — aggressive or moderate.

Of course, risks of losses exist despite careful selection. Cryptocurrencies are especially sensitive to regulators’ actions, especially when their goals are not clearly defined, although such coins are particularly volatile and can earn 50-70% per year. But even one wrong decision by the manager can quickly turn profit into loss.

To prevent this, less than 30% of the portfolio should be in the top-10 cryptocurrencies by market capitalization: Bitcoin, Ethereum, Bitcoin Cash, and others. Their positions are relatively stable, despite periodic sharp fluctuations, and there’s a chance that when everything is really bad, the fund can sell these assets and recover at least part of the invested funds.

In conclusion. Investing in cryptocurrency funds is a good diversification method for passive income sources. Given that major hedge funds and investment banks such as Goldman Sachs and J.P. Morgan plan to enter this market, it can be said that their capitalization and profitability will only grow over the next 1-2 years.