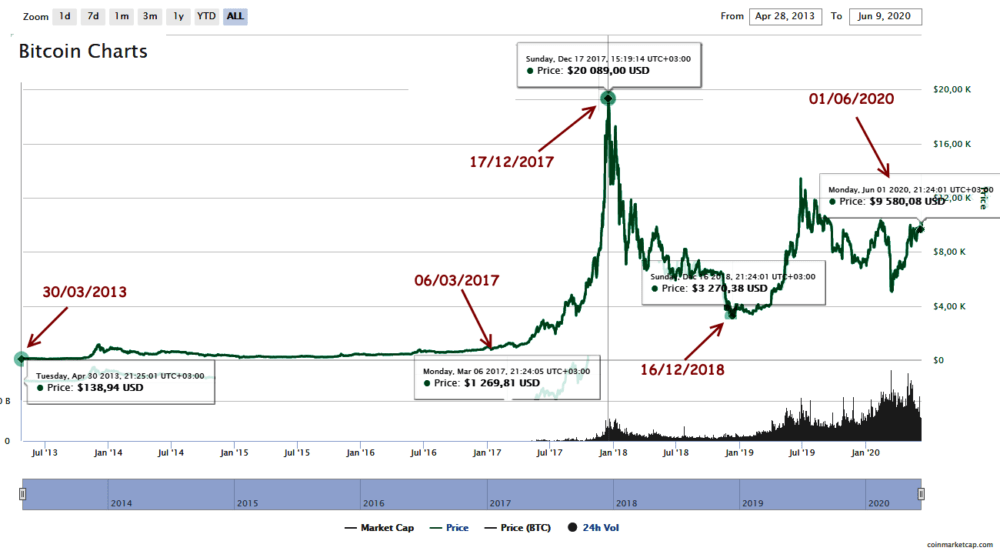

Traders horrorfully remember Bitcoin’s “rally” in December 2017, when a sharp rise to $20,000 was quickly followed by a catastrophe. Let’s try to understand why cryptocurrency volatility constantly changes and how to profit from it.

The price has not managed to return to the previous level and for a long time, BTC futures fluctuate within $9300-9800. However, besides major crash trends, intra-day fluctuations of 20-30% from the opening price regularly occur in cryptocurrencies, which is extremely rare in currency and stock markets. Why is that?

All the following statements represent the personal opinion of the authors, and our main goal is to show the reader that the more “unstable” an asset is, the more you can earn by understanding its features.

- Reasons for Cryptocurrency Volatility

- Cryptocurrency has no real backing

- Difficulty in determining the optimal price and unstable capitalization

- Weak control over crypto exchanges

- Weak competition with traditional payment methods

- Negative public opinion

- Inconsistent policies of governments and regulators

- And what’s the result?

Reasons for Cryptocurrency Volatility

All factors influencing the quote of any asset — stocks, currencies, options, or futures — can be divided into two groups: economic (market) and social. Let’s start with economic factors, as most crypto traders, especially beginners, do not consider them serious, being charmed by the possibility of quick speculative profit.

So, sharp and unpredictable movements of digital currencies are caused by the following reasons:

Cryptocurrency has no real backing

The term “real backing” is often misunderstood and considered either nonexistent or unnecessary. Cryptocurrency enthusiasts love to talk about the lack of gold backing for fiat money, the speculative nature of futures, and artificial politicization of national currency rates. In reality, the situation is exactly the opposite.

Yes, 99% of futures and Forex deals do not go to the stage of exchange for real goods or export-import financing, but such an opportunity remains. Simply put — the parties to the deal can always receive in “real” terms the specified tons of wheat, barrels of oil, or purchased currency, which cannot be said about cryptocurrencies.

The value of all digital money is determined solely by the “optimism” of their owners and various “rumors” about bans or, conversely, “support” for digital money. There is no stable fundamental background like, for example, in the dollar or euro, so it is currently difficult to make medium- and long-term forecasts using classic market analysis methods.

Difficulty in determining the optimal price and unstable capitalization

Since there is no link to real assets, it is almost impossible to determine a “fair” market price. Here, another objection might arise that on other financial markets, large speculators also determine prices, but this is also fundamentally incorrect. Let’s recall one of the main principles of Dow Theory — “the price incorporates everything”. And it indeed was confirmed long before the birth of this market guru — when 200 years ago, Japanese candlestick analysis appeared. Just, the real “everything” and the crypto “everything” are fundamentally different concepts.

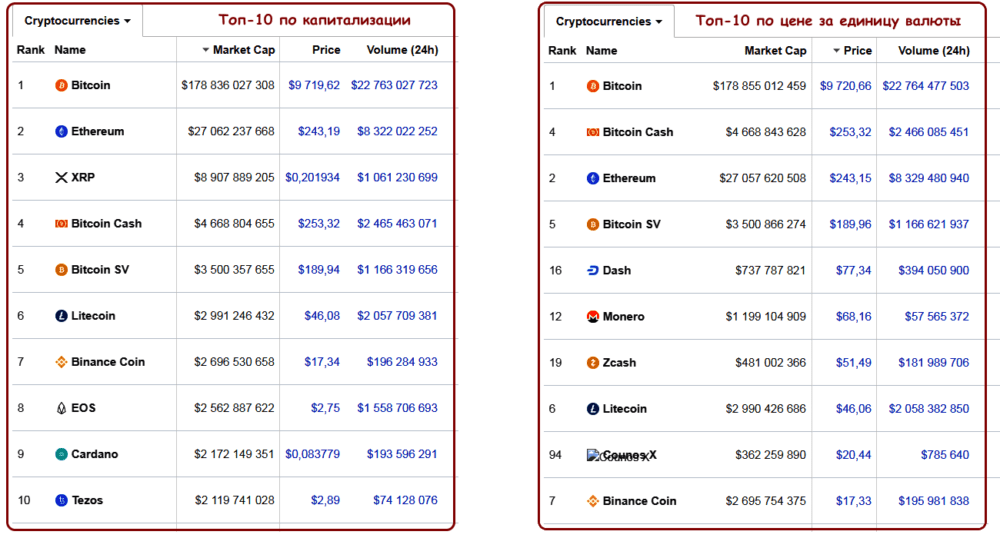

Pay attention to the capitalization of cryptocurrencies outside the leading group. Recall that it is calculated by the formula (Number of coins on exchanges) * (Current price). According to Bloomberg data, as of April 2020, the market capitalization of Warren Buffett’s Berkshire Hathaway and related financial structures was slightly over $520 billion, with only about $125 billion in free cash. This monster can buy back almost all Bitcoin in circulation at any moment, even with a “fresh” rise in price. Smaller crypto assets are even more vulnerable.

Thus, the low total value is one of the reasons why cryptocurrencies are highly volatile. Especially when a large part of the coins are held by developers and a few major investors, as in Ripple or TRON. In such cases, regular “pump & dump” schemes are possible, where the price artificially grows on hype, then sharply falls, and only the organizers profit.

Weak control over crypto exchanges

It is hard to imagine stocks of Apple or General Motors being sold on an exchange registered somewhere in the Virgin Islands or another offshore zone, where even the owners’ names are not disclosed, let alone financial reports. For cryptocurrencies — this is common, except for Bitcoin futures traded on the CME. But they are mostly dealt with by large players, while others trade at their own risk. Trading platforms are not connected; liquidity exchange does not happen, unlike stock exchanges. This manifests as significant price differences (which can be exploited for arbitrage) and divergent movements of the same asset.

Now, moving on to social factors, which increasingly influence digital money. Here, three negative trends make the market uncontrollable and speculative.

Weak competition with traditional payment methods

This factor, although related to economics, is better classified as a social phenomenon. Classical political economy considers convenience, low ownership risks, and universal recognition as a means of value assessment as features of money. An illustrative example is the US dollar and VISA/MasterCard payment cards.

In the first case, we have a universal means of payment: in this, USD can only be rivaled by the euro and British pound. In the second, maximum convenience — no need to carry cash, and payments can be made online or by card everywhere (unless you are in the desert or jungle) in a few seconds.

Cryptocurrencies still cannot offer a worthy alternative, and instead, we constantly hear about transaction speed problems. The very concept of blockchain with its random node selection for confirming money transactions cannot provide speeds comparable to “classic” card payments, which becomes a surprise for newcomers trying to pay for coffee with Bitcoin. Therefore, large banking and exchange players are unlikely to invest in retail (and even mid-term) processing, and such information is not available even by mid-2020. But they control the active market, preventing sudden growth or decline.

Negative public opinion

This is not the most significant reason for crypto volatility, but regular news about exchange hacks and wallet thefts with full loss of funds do not boost optimism. Especially when this happens on large platforms, where losses amount to tens of millions of dollars. All this sharply lowers the rate, and it’s clear why traders rush to close deals and withdraw profits at the slightest chance.

Inconsistent policies of governments and regulators

Digital assets have no counterparts in current civil and economic law. At the same time, one cannot follow China’s example, which first completely banned mining and ICO projects, causing a sharp drop in the entire crypto market, then later clarified that everything was allowed, but it’s unclear to whom, how, and how much. Considering that a large part of mined coins come from Chinese miners, any news or “rumors” from China cause Bitcoin fluctuations of at least 10-15% over several days.

New legislation and regulations are needed, which takes time and specialists. Any regulator wants to ban everything “until better times.” It should be understood that the reasons for strict regulation are not always a “conspiracy against the future”: if the buyer and seller remain completely anonymous when settling for goods and services, who will be responsible for poor quality, crime, and other issues? So, the war for the legality of crypto settlements is just beginning.

And what’s the result?

In reality, things are not as pessimistic as they seem at first glance. The factors influencing crypto volatility are gradually losing their significance, while crypto exchanges are growing larger, licensed, and increasing security. Negative news no longer has a long-lasting impact on the market, and the period for recovering previous positions ranges from a few hours to a day. So, a prudent and cautious speculator always has a chance!