If you look at the market capitalization of the TOP-10 digital currencies, you can notice that even Bitcoin, if desired, can completely buy out an average hedge fund, and an investment bank even more so. This means there are many opportunities to influence prices speculatively, which has long and successfully been done through pump and dump schemes in cryptocurrencies.

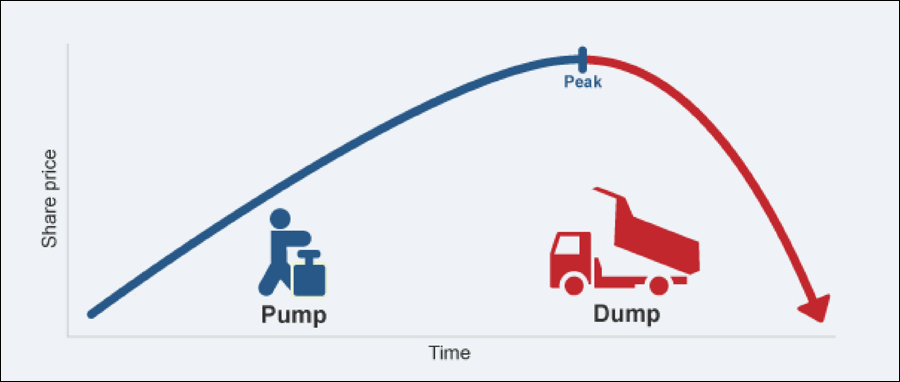

These types of exchange speculation first appeared on the stock market and became one of the main reasons for the Great American Depression of 1929. Everything is done according to a “classic” financial pyramid scheme. The owners of the main or controlling share package decide to artificially increase the value of the asset (Pump), and at the right moment, when they believe the market has reached its maximum price, they close their positions. Naturally, the quote sharply falls, leaving others at a loss (Dump). In cryptocurrencies, a price drop can be caused by rapid mining or a large influx of pre-mined coins into the market.

In the cryptocurrency market, similar schemes most often involve “garbage” digital assets, which are dozens of times delisted from exchanges every month or are issued solely for speculation, including through ICO tokens. To promote a project, all channels are used: from publishing non-existent financial reports and marketing plans to various “insider” information and opinions from “experts and analysts.”

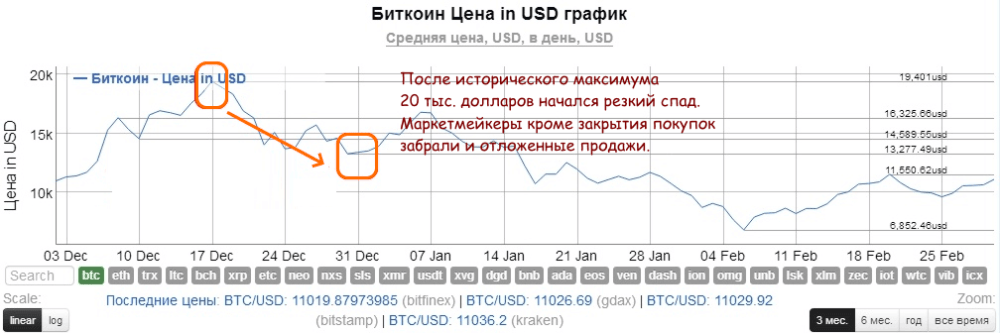

Don’t think that cryptocurrency pump is only speculation on unknown or low-value coins. The lack of a clear legal framework and, consequently, serious regulation, plus inflated expectations of quick profits, have led to periodic speculation even among market leaders. A clear example: the sharp rise of Bitcoin futures in December 2017 followed by a nearly 100% drop is a textbook example of Pump&Dump.

How does it work?

The basic scheme can be broken down into four stages, which in different variations are observed even in 2020:

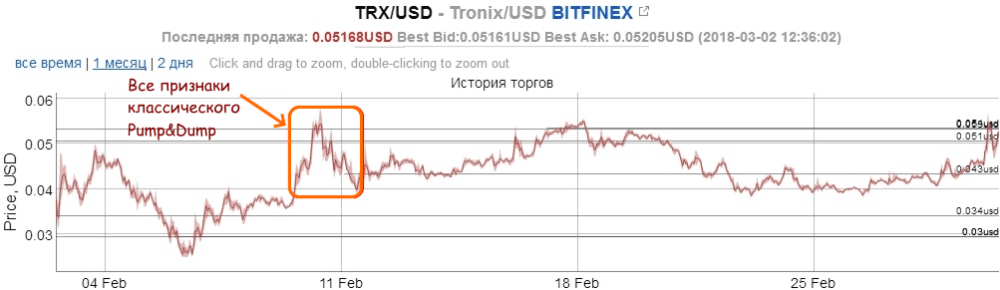

- Find a little-known cryptocurrency with low market capitalization and trading volume, sometimes called a Shit-Coin or Pump-Coin. Sometimes, a separate coin is issued specifically for a new fundraising round. An example can be TRON. It can be argued that coins that regularly enter the TOP-10 are not considered “garbage,” but immediately after listing on exchanges, there were periods of rapid growth by 200% in a day and a return to initial quotes after trading hours.

At the first stage, initiators try to buy as many coins as possible, especially if they have pre-mined or control the majority stake, thus fully controlling the situation. Simply put, other participants cannot accurately determine the optimal entry point into the market.

- Once the coin is selected, they begin information pressure on novice traders or “hamsters” called pumpers. Usually, this is done through Telegram channels, where complete anonymity can be maintained: regularly appearing “verified” news about imminent price growth, opinions from “analysts” — technical and especially surprisingly fundamental ones, although such forecasts cannot practically exist. Simultaneously, exchange bots start buying large volumes to increase activity around the coin, while in reality, it’s just money transfers between “own” wallets. The constant growth attracts attention, and more traders get involved. There are sites, forums, and closed channels online and in messengers fully dedicated to promoting pumps. The project description openly states that it’s a pyramid, and most investors will lose money unless they “get on the train heading for profit” first. It’s a game of greed and the desire to be in the “know” when the rise will end and the fall will begin. The result: losses or even complete bankruptcy.

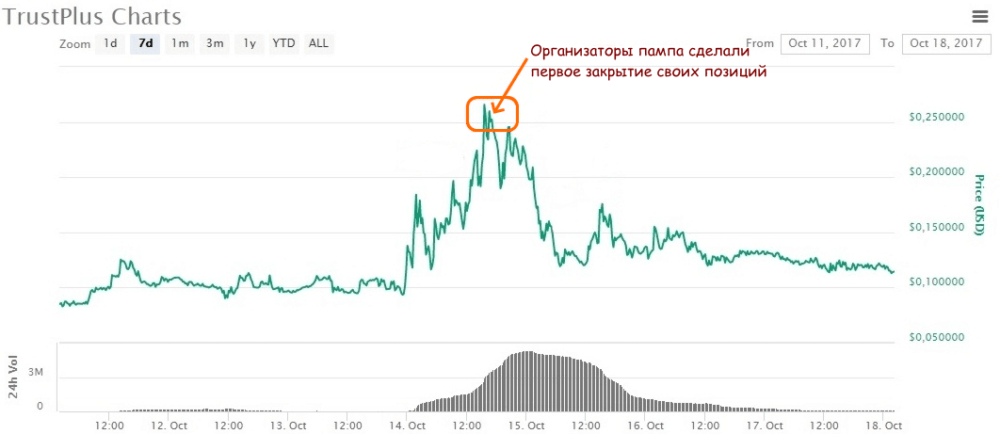

- The peak of activity and start of sales. The price steadily rises, insiders gradually start selling. It’s important to understand that with low capitalization, a few false pullbacks and corrections are needed to attract traders trying to catch a trend that has already ended in fact.

- Disappearance of illusions of profit. Major players remove maximum liquidity, leading to a rapid fall in price. This happens so quickly that even short positions (shorts) become unprofitable: there are no buyers, and the broker or exchange, unwilling to buy positions at their own expense, simply halts trading or removes the asset from the listing. Now, the pyramid creators are out of reach, calmly counting profits and thinking about how to start all over again.

Where is this done?

Currently, such speculation is almost absent on major platforms. The reason is not only in the complex insider detection method with subsequent account blocking without return of earnings, but also in the limited number of assets that undergo audit before listing. For example, on Bittrex, about 200 cryptocurrencies are listed, but even then, it’s not very interesting for pumpers — they need less active coins.

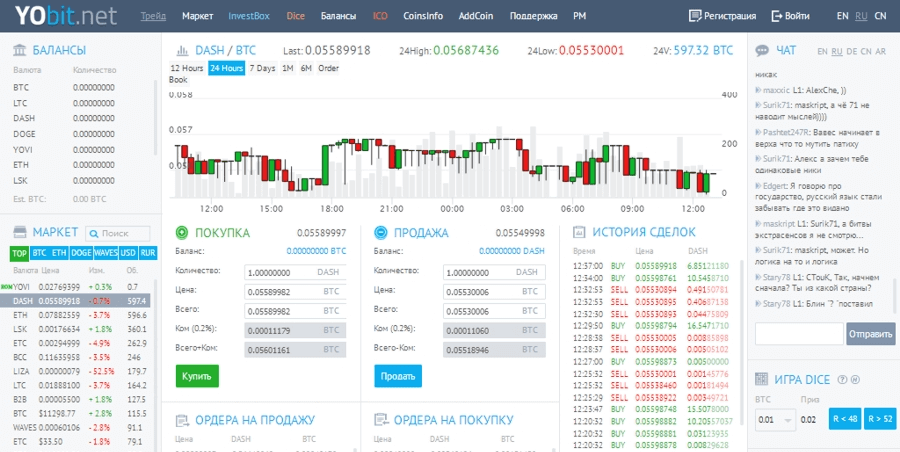

They go to exchanges where the number of coins and tokens is at least 500-600, for example Youbit. Adding your currency can cost 0.5 BTC with minimal moderation. Note: the exchange is just an example — how to trade and what each person decides for themselves!

How to profit from a pump

If you are not one of the organizers of a quick (short-term) pump, it’s almost impossible to make money on it: the speed of selling doesn’t allow entering “at market” for sale. On “medium and long” projects, you can try to buy after the first pullback during the growth (point 1) or during the sell-off (point 2). With good luck, you can earn 20-30% of your investment, which is good for a trade lasting 20-30 minutes. Main condition: fastest possible opening/closing of orders by the exchange or broker!

A typical Pump&Dump strategy involves a small correction just before the final drop when major players leave the market, and others try to reverse the price upward. Try to open a buy at the minimum (point 3) and close when the reversal fails (point 4) and the market enters flat.

For Pump-Coins with a capitalization under a million dollars, secondary peaks are almost never seen due to insufficient resources for corrections and pullbacks.

How to recognize a pump?

Despite nearly 10 years of hype around cryptocurrencies, no prediction method guarantees sufficient reliability, even when using proven technical analysis tools. Main reasons: lack of real backing (even for stablecoins) occasionally raise questions), and not all jurisdictions regulate digital money clearly. This situation creates ample opportunities for speculation, but there are some signs of a pump that even “beginners” can recognize:

- After a long period of silence or right after the coin appears on the exchange, activity rapidly increases. Large buy and sell orders appear and disappear, mostly on the buy side; volatility during the session can reach 100% or more from the opening price. At the same time, other platforms do not show this. These are the first signs of unhealthy hype, and you should try to close your positions regardless of whether it’s a pump or not.

- When activity increases, the next step is mining. As mentioned before, it takes a lot of coins to move the course. Creating new coins or circulating pre-mined ones is more profitable than buying from the market with real money. Classic mining on a PC doesn’t require large costs for Pump-Coins. Maintaining liquidity during the rise is necessary, so reserves are needed. Signs that mining has started include increased difficulty or node activity. If in the past 1-2 months, activity suddenly increased, something is preparing on the market soon.

- The main sign that a pump has started is active advertising promising huge profits, but only for the chosen few who can wait until the price reaches its peak. Those already dreaming of gold bars in Swiss banks to withdraw “advertising magic” should think about why in civilized countries there are outright bans on specific income figures from investments and trading. Right: because hedge fund analysts and banks are not gods and cannot predict the future with 100% certainty, although it often seems so. Any guarantees here are a sure sign of deception!

In conclusion. Unfortunately, the history of “money scams” from financial pyramids to fraudulent ICOs shows that the desire for quick profits will continue to cloud people’s judgment. Pump and dump schemes in cryptocurrencies will appear periodically and take their toll. The only advice: even if you spot early signs, don’t overestimate your abilities and financial capacity — you have no chance against professional pumpers, and even in a casino, the odds of winning are higher.