Privacy of financial transfers was the main reason for the transition of digital currencies from merely theoretical development to practical use in economic processes. Unfortunately, as the number of users and transactions grew, it became clear that confidentiality was only on paper, and in reality, it is absent. Deposits on crypto exchanges, password and key thefts, online wallets conducting operations through external servers — all these factors make it possible to precisely identify who, how much, and to whom transfers are made. However, Monero cryptocurrency still allows users to remain anonymous.

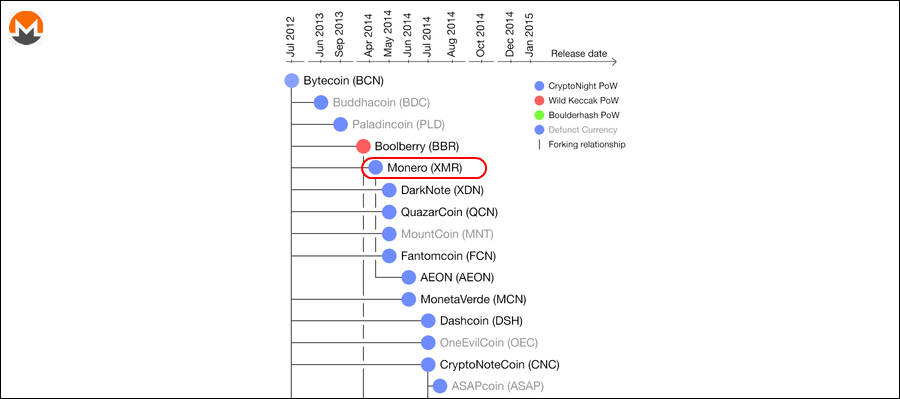

Let’s go to the official website for basic technical information. So, MONERO, or Monero in English, is a cryptocurrency that uses the CryptoNight encryption protocol. It is a hard fork of ByteCoin (not to be confused with Bitcoin and Bitcoin Cash). The reason for the fork was that 80% of ByteCoin wallets were concentrated among its creators, which created opportunities for price speculation. Community negotiations with the founders were unsuccessful, and it was decided to create an entirely new currency.

Like many digital currencies, you can set your own transaction fee and thus prioritize your transactions over others. The initial emission limit is set at 18 million coins, with the mining reward gradually decreasing to a fixed 0.6 XMR.

How user protection is ensured

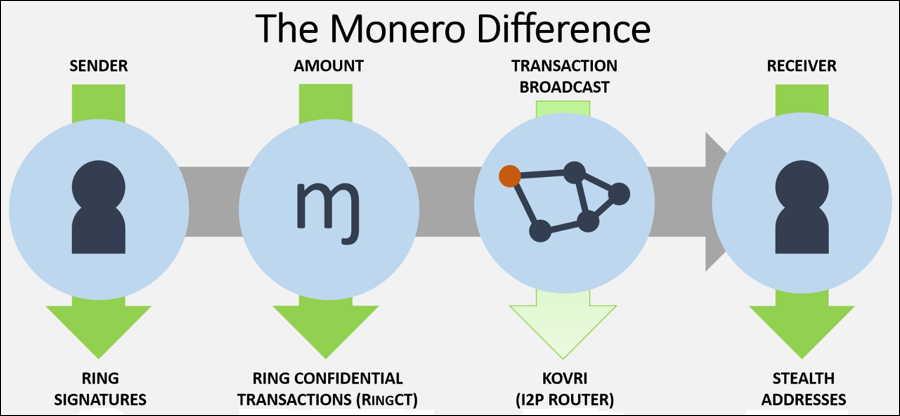

The creators of Monero believe that recording in the blockchain, which is an open database without encryption (as in Bitcoin), of sender/receiver addresses, transaction amounts, and wallet balances does not promote anonymity. Network traffic analysis of leading market networks shows that the basic principle of randomly selecting nodes for transaction confirmation and processing has long ceased to work. In Bitcoin and Ethereum, at peak times, up to 70% of daily transactions are processed by 5-10 nodes, and their true owners remain “in the shadows”. To address this, new technologies have been developed:

Fungibility

It should be present in all digital and fiat currencies. All monetary units should have the same properties and match their nominal value regardless of how many transactions they have undergone in the past and will in the future. While there are no issues with paper fiat money, in the case of cashless payments and cryptocurrencies, each movement can be traced from the moment of creation. If a bank transfer from an unknown source can be returned and disputed because sender data is available, digital coins are, in a formal sense, “come from nothing,” and you can easily become involved in actions unrelated to you.

Fungibility would also be useful for personal payments, even if they are completely “clean.” Honestly, isn’t it better that the entire network can see through the blockchain how much and where you paid? Yes, you can use “mixers,” but most of them have a bad reputation and are under the control of authorities. Being guaranteed to fall into a “dirty money” scheme is also not the best option.

Monero solves the fungibility problem by making multiple pre-transfers between wallets before a transaction is executed. Thus, for the first time, the phrase “money doesn’t smell” applies to digital currency.

Ring signatures

Now, transactions can be signed with a digital signature both from yourself and on behalf of a group of wallets. What does this mean? It is now almost impossible to determine exactly who made the transaction, and to identify the specific chain of blocks in the blockchain. Ring signatures can be used both online and offline with subsequent information upload after connecting a node to the network. This completely eliminates the possibility of double spending.

Stealth addresses

In addition to the public key, which matches the wallet number, the system allows using two private keys: for spending (spendkey) and for viewing (viewkey). Compare this to Bitcoin, where the pair “public + private key” is used repeatedly. If desired, this can be linked to other data, such as IP address, and reveal all personal data of the owner. However, with Monero, each payment can use a unique combination of keys.

How mining works

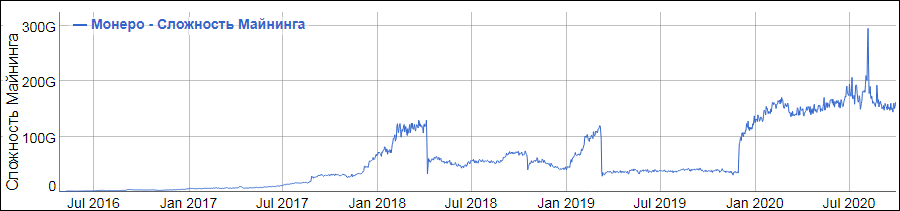

Looking at the difficulty growth chart, long smooth sections are clearly visible, followed by sharp jumps. Their cause lies in the mining algorithm used and Monero’s development policy.

The CryptoNight algorithm was originally developed to give an advantage to central processors (CPU) over graphics cards (GPU), traditionally used in mining. From a theoretical point of view, this is true when considering only CPUs. In practice, there is no significant gap; on the contrary, if other computer components (RAM, motherboard bus, and hard drive) are not the fastest, the performance gap narrows. Calculations often show that the cost of a mining rig with GPUs is not much higher, and there are more currency options.

Repeated attempts have been made to develop ASIC devices to accelerate the process, but developers are fundamentally against this. They modify the algorithm twice a year, after which new ASIC chips need to be developed and existing computing power expanded. This explains the periodic “peaks and troughs” in difficulty, after which a slow growth resumes.

Coins can be mined both solo and in mining pools. However, considering the small fee shared among participants, this is not a serious source of profit.

Register an account on a trusted exchange ByBit

Market situation

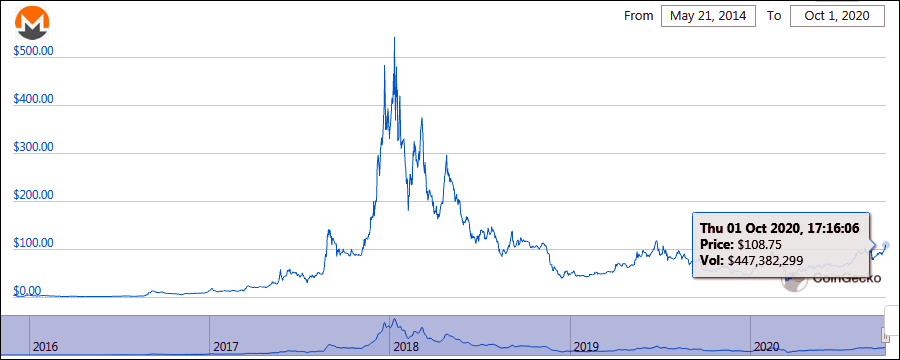

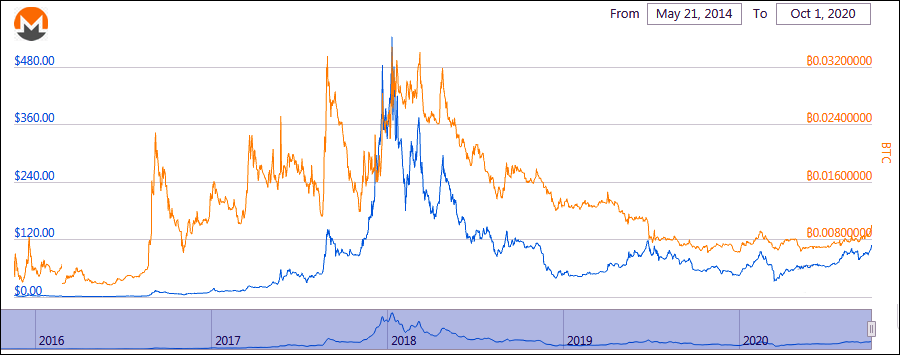

In 2020, the exchange rate to the dollar showed modest volatility, and there are no signs that the ruble or dollar rates will sharply rise or fall by the end of the year. As of September, the market cap is $1.9 billion and remains in the TOP-10, which is a good result for a coin called the main cryptocurrency for the “shadow” internet.

The rate follows Bitcoin with less volatility, which is good for beginners. Trading is calmer, with less risk of losing your deposit due to sharp price impulses. There are also no issues with converting to fiat or other cryptocurrencies through exchange points.

What is happening now with Monero

Predicting how the cryptocurrency market will change even over the next six months or a year is almost impossible, despite claims from various “analysts and experts.” However, some forecasts can be made based on the understanding of the currency’s purpose:

- The trend in the rate will continue. The price, with some delays, will repeat Bitcoin’s movement. It’s important to understand that this applies to all currencies, except perhaps Ethereum, which occasionally shows short-term deviations from the main trend. Bitcoin, as the only asset traded on the CME stock exchange, “drags” others along, which have nothing but loud statements from creators and inflated expectations from owners.

- Unlike others, the currency has a fundamental factor. The events of 2020 raised the question — is everything really as anonymous as the creators claim? The catalyst for unrest was the US Tax Service and the Department of National Security, which announced contests to develop means of transaction control and circumvent Monero’s anonymity. According to unconfirmed reports, winners have already been identified, and work continues in secrecy.

- The pursuit of maximum confidentiality has become an insurmountable obstacle for “white” internet use as a payment method. It’s hard to imagine selling goods and services if both sides do not provide personal data, at least for delivery. And if they do, why connect with a cryptocurrency that has a dubious reputation? Many crypto exchanges also exclude XMR from their listings. Among the largest platforms, Coincheck, Korbit, Coinspot, and Huobi Korea have already done so.

- Mining only on CPUs attracts miners with limited budgets, but prospects for this approach are not optimistic, especially when the reward for a new coin reaches a minimum. Even the most modern processors lag behind mid-range ASICs in performance, and with higher energy consumption and increasing difficulty, more profitable projects may see miners leaving.

However, if Monero is used only as a trading asset, it is quite possible to earn well. Its current price does not require large investments to start trading, especially with leverage. Use classic technical indicators and strategies both intraday and for medium- and long-term positions. Scalping is not recommended!