Virtual money has long become a norm in our lives, but this also brings many problems and questions. Meet: the first in history “digital gold” — Bitcoin.

Cryptocurrencies (or “digital money”) are less than twenty years old, but they have already become a global phenomenon, constantly discussed in the media, on the internet, and in reports of leading investment banks and hedge funds. Even people who are far from finance and mathematical algorithms start to wonder: what is Bitcoin — theory or programmer jokes, another “pyramid,” a new means of calculation, or the end of the existing banking system?

Reasons for the emergence of Bitcoin

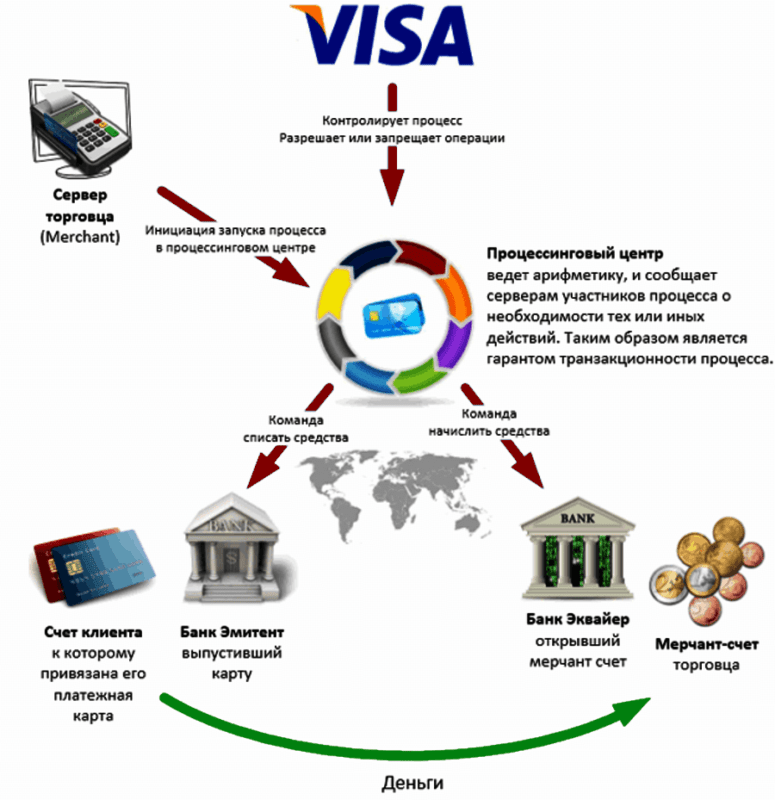

Traditional financial operations, which everyone is used to, share a common problem: for a payment to be “completed,” a mediator in the form of a bank or non-banking payment system (PayPal, Skrill, WebMoney, and others) is required. This is both a positive and negative factor.

Thus, the presence of a financial intermediary guarantees the execution of payments both online (via the internet) and offline (retail outlets, ATMs).

On the other hand, all financial flows are under control — not only by tax or other official authorities. Every year, payment systems collect more and more personal data, and owners of bank accounts or payment cards do not know who, how, and why this information is used. It is clear to everyone that such an approach is dangerous not only for money but also for personal life, which has led to the need to restore the right to confidentiality of settlements by creating an alternative to the “traditional” payment system.

Before the appearance of cryptocurrencies, attempts to implement such ideas were made repeatedly, and there are several fairly successful solutions, for example, the aforementioned PayPal. But the main problems were not solved: the presence of a centralized transaction processing and the requirement to provide personal data to access all system features.

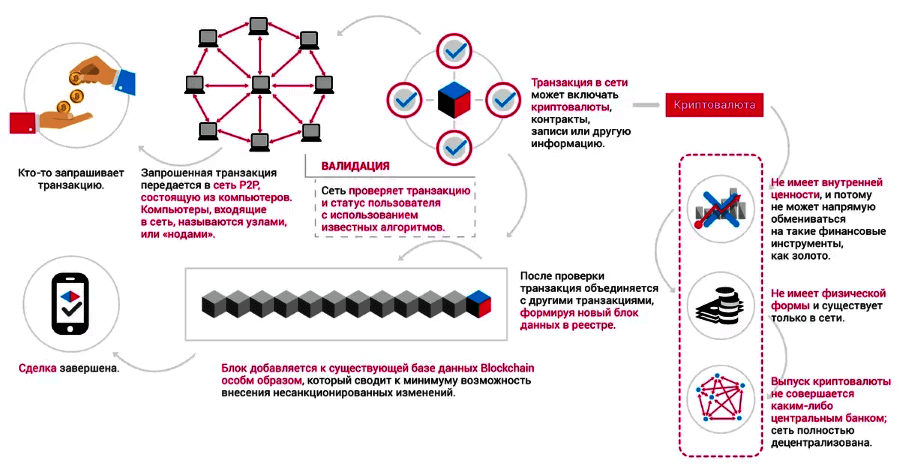

Indeed, Bitcoin became the first successful implementation of the “blind” cryptographic signature algorithm, where participant data (nodes), confirming the authenticity of a transaction, remain anonymous, and all payment data are stored in an immutable database called “blockchain”. This is the dream of everyone who does not like the current banking system — a fully decentralized and confidential payment network.

How does it all work?

We will not describe in detail the mathematics of the cryptographic algorithms used or figure out who Satoshi Nakamoto really is. All this can be easily found on the internet. Instead, here we will explain in simple language, “for beginners,” how a payment (transaction) between nodes (wallets) of the network works.

So:

- A new payment is created in the network between the sender and receiver (wallets), which are connected via P2P protocol (peer-to-peer). Similar to torrent networks: the file being downloaded is held by many “seeders,” and the “receiver” downloads parts and assembles the original. In cryptocurrencies, this is a “chain” of blocks recorded in the blockchain. It is unknown through which nodes the transaction will pass — the importance of this mechanism will become clear from the next points.

- Due to decentralization (in theory), any digital currency network cannot use the “classical” trust scheme, where a third-party guarantor ensures the deal’s execution. To prevent fraud and, more importantly, double spending, a circular pledge algorithm (routine escrow algorithm) is used, where nodes directly involved in the transfer of coins guarantee the authenticity of wallets, correctness of balances, and other important parameters of the deal.

- For Bitcoin, at least 6 nodes are needed for a transaction to be considered valid and for the corresponding record to be entered into the blockchain. Nodes are chosen randomly. At this stage, the first problem of all cryptocurrencies arose — the larger the network, the “further” nodes can be located, which means that confirmation time increases. An ordinary VISA/MasterCard card works much faster — even the most ardent supporters of digital money cannot deny this fact.

Important advantage: the cryptocurrency network does not depend on the performance of a specific node. The more nodes, the higher the network’s resilience to failures. Of course, reality differs from theory, but overall, this principle works.

Where do coins come from?

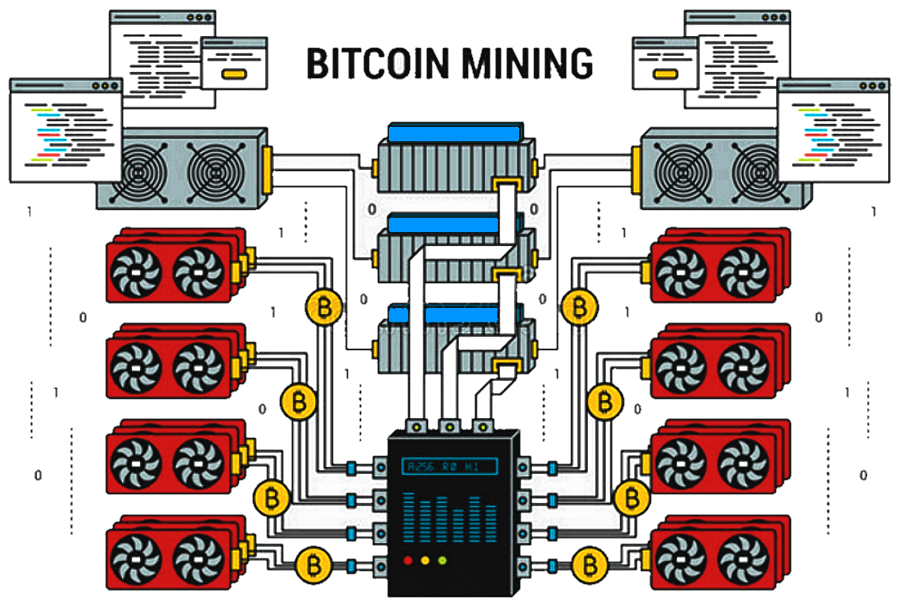

Of course, from the “mine.” When people first “see” digital money, a natural question arises: if everything is decentralized, who controls the issuance of “these coins”? The answer: miners (from mining — to mine). They use computer equipment to find new blocks (hashes) and add them to the network. When a block is found, a reward is paid — as of May 2020, it’s 6.25 BTC.

Bitcoin’s algorithm established the main rule for all subsequent cryptocurrencies or forks. The maximum number of coins (blocks) is either predefined (in our case, 25 million) or they are issued (mined) in advance. In any case, coins do not immediately enter circulation, which, according to crypto theory, should reduce “crypto-inflation,” which has nothing to do with real economics. We will not argue why this is so, but in all currencies based on Bitcoin, there is a difficulty parameter for obtaining (mining) a new block, which constantly increases. That’s why the largest mining farms have thousands of computers and consume 3-4% of the world’s electricity at peak loads.

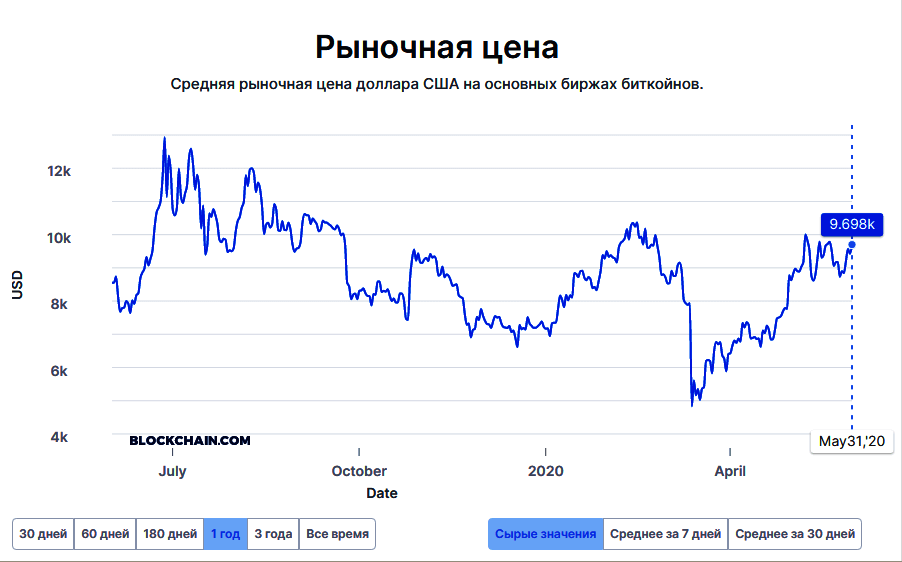

Cost and regulation

Current prices are constantly published in the media, and one might think they are similar to stocks, options, and futures for oil, gas, etc. But in reality, this is not quite correct at the moment. Let’s ask ourselves — what does the price of an asset that has no connection to the real sector of the economy depend on?

The simple answer: the value of such exchange-traded instruments can only be speculative — meaning, it is derived from a universal analytical tool called the “ceiling,” used even by the largest banks and funds. Simply put — an analyst or trader looks up and says “it costs…”. That’s exactly what Mr. Nakamoto, the creator of the first cryptocurrency, did when setting the initial rate at $1 = 130903 BTC. Of course, normal market prices for stocks and currencies do not work this way.

The fact that such “virtual assets” do not have a real basis for their value means both the risk of losing all investments and the opportunity to earn quick speculative profits, which can later be converted into “real assets.” This ambiguity of cryptocurrencies raises concerns among professional investors like Warren Buffett or investment banks. For example, JP Morgan, in its annual investment recommendations, advised caution regarding cryptocurrencies and other “virtual” assets.

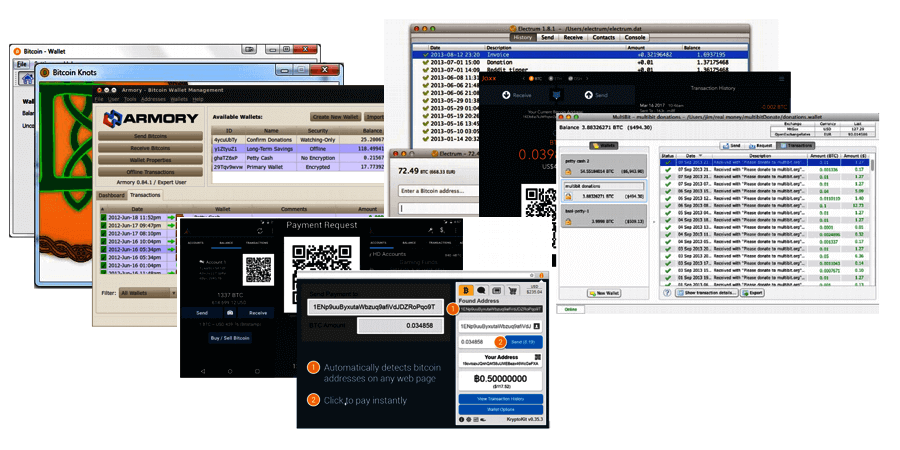

How to store, buy, and spend Bitcoin

To start making payments, simply install wallet software on your computer, laptop, or mobile device (tablet, smartphone). Versions are available for all operating systems (Windows, Linux, Mac OS, Android, iOS). Mobile wallets conduct transactions through external servers, which then determine which network nodes will be used for confirmation. Of course, full anonymity is not possible, but there is no alternative.

Computer and laptop wallets can contain a full copy of the blockchain (“thick” wallets) or its part from the last few months (“thin” wallets). This provides an independent node for making payments; this option is the only one suitable for commercial activities, as it guarantees the absence of external interference or minimizes it.

Important! A wallet confirms a payment with two cryptographic keys: a private key (created during software installation) and a public key (which can be permanent or new for each transaction). Losing or changing the public key makes access to the balance impossible, and there is no recovery mechanism.

You can buy Bitcoin on crypto exchanges, in electronic currency exchange offices, or receive it for goods or services. Exchanges and exchange offices perform the reverse operation — converting BTC into real money for subsequent payments, but this is not mandatory. Virtually everything can be bought online with cryptocurrency — just be aware of the high risk of scams due to anonymity and possible restrictions in your country or on registration of online stores and websites.

What are the prospects?

Despite all problems, such as hacking, slow transaction speeds, or technological complexity, digital currency continues to develop, and the flow of information is rapidly increasing. It can be confidently said that crypto has become an integral part of the global economy and social life. Stock exchanges are considering adding new currencies to their listings, Japan has introduced them into circulation alongside the yen, and in Russia, draft laws are being considered to provide benefits to miners and legal recognition of “digital assets.”

At the same time, the discussion of what Bitcoin is remains relevant. Its supporters have yet to give a clear answer — what does it differ from regular money besides maximum anonymity? Cash bills perform the same function and are not intended to disappear despite all efforts by banks to move money flows into cashless form. The future will show who is right, but earning on digital money is already possible and necessary now.