When you hear “cryptocurrencies,” what is the first thought? Naturally, Bitcoin, which everyone knows thanks to the media and the internet. It seems there’s nothing else, but this is fundamentally incorrect. In this article, we will explain what altcoins are, their current state, prospects, and how you can make money.

First, it’s worth clarifying the meaning of the term altcoin (English: altcoin, alternative currency). The cryptocurrency community holds two opinions on this:

- Refers to all “non-Bitcoin” digital coins, including direct “descendants” of the classic such as Litecoin and Bitcoin Cash.

- Only those that use principles different from Bitcoin: mining methods, transaction confirmation mechanisms, etc.

Which of these is correct? In our opinion, the first, because primarily digital currencies were created as a new means of payment, regardless of how “related” they are to Bitcoin. The main thing is whether they perform their core function or not.

Another common question — are tokens from ICO projects an alternative currency? The answer: no, even if they are traded on exchanges alongside other currencies. Essentially, they are more like stocks than money; currently, there is no such thing as a “cryptocurrency stock exchange.” Read more about what tokens are on our website.

Why and how are Altcoins created?

There are two main goals: to create a completely new coin with unique features or to solve issues of an existing one. From a technical perspective, this is implemented as follows:

- A new protocol for data transfer and blockchain operation is created in the cryptocurrency. It requires significant time, human, and financial resources, but if a truly new solution is needed, it’s unavoidable, although there are exceptions. For example, Bitcoin Cash, whose foundation, despite many changes and additions, is still based on “classic” Bitcoin.

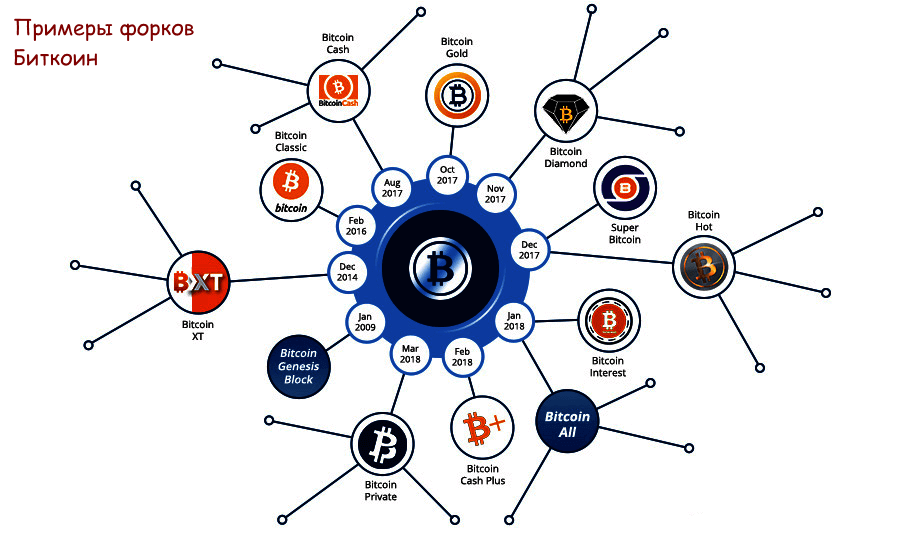

- Based on an existing currency through a soft fork or hard fork. What are these? Read in the terminology reference. The “soft” option requires less expenditure, while the “hard” fork requires new wallet versions and the consent of the majority of the community and major miners for irreversible changes.

Most new currencies are also made using premine schemes, where all coins are issued in advance and distributed among holders according to a certain algorithm. This approach required new confirmation algorithms, such as PoS (Proof Of Stake) and PoR (Proof of Reserves). We won’t go into technical details, only say that now, for confirming transactions and earning rewards, it’s enough to install a full copy of the blockchain (a node) on the computer, and in some cases, maintain a non-zero balance on the wallet.

Examples of Altcoins

The count of alternative coins in 2020 already runs into thousands, but most are created as experiments (how to do it yourself — read further) or for speculative purposes (pump & dump schemes). We selected several examples that prove they can also solve real problems:

Litecoin

Considered the first altcoin (although there are other contenders), created based on Bitcoin’s code. Compared to Bitcoin, it has the following advantages:

- A block is mined four times faster, and there are more coins: maximum 84 million (Bitcoin has 21 million);

- Hashing algorithm Scrypt, which limited mining speed until ASIC devices appeared;

- More “smooth” network difficulty adjustment: the speed of change depends on the time taken to mine the last 2016 blocks;

- High transaction speed using SegWit2x technology.

Ethereum (Ether)

Second after Bitcoin by market capitalization. Initially developed as a platform for smart contract processing, it gained popularity as a means of payment. As the network grew, a natural slowdown in speed was observed, which was supposed to be solved by a global soft fork. Discussions about it have been ongoing for over 1.5 years, but the network updates have not yet happened.

Tether

Creators claim that each coin is backed by real (fiat) assets: dollar, euro, or yen. Such currencies are also called stablecoins. Which fiat currency is backing this crypto can be found out from the exchange ticker: USDT, EURT, JPYT. When exchanging for real money, the corresponding number of coins is removed from the crypto system account.

Is the currency actually backed by real money or just a marketing move “for beginners” — it’s unclear. The results of audits do not give a definitive answer. Despite this, Tether has long been in the TOP-10 by market capitalization.

MONERO

Main goal — maximum user anonymity. As analysis of Bitcoin and Ethereum payment flows shows, the principle of random route selection for payment passing has long been violated, especially for mobile and online wallets: most transactions pass through several major nodes and crypto exchange accounts, which makes it possible to establish the identities of the participants. To prevent this, MONERO uses:

- Fungibility. Before reaching the recipient, the payment is automatically split into several smaller parts that go through different routes and are then “assembled” again just before crediting. Other currencies do this via third-party “mixers,” whose ownership and further transfer are unknown. Here, everything remains guaranteed within the MONERO network.

- Ring signatures. Payments can be confirmed either by the sender or on behalf of a group. Simply put, it’s unknown who exactly did it, ensuring confidentiality.

- Stealth addresses. In addition to the main wallet (public key), two private keys are generated: one for viewing (viewkey) and one for spending (spendkey). Private keys are unique for each transaction.

The CryptoNight mining algorithm is constantly becoming more complex to combat mining with ASICs. This approach preserves advantages for CPU+GPU-based systems and prevents rapid “pumping” of large coin amounts, making the coin’s rate more stable.

Ripple

Positioned as an alternative to traditional bank transfers, both in terms of speed and the absence of intermediate conversions to dollars or euros for rare currencies. All transactions go through authorized partner nodes, which leads some cryptocurrency supporters to believe that it’s not a truly decentralized system.

In reality, even Bitcoin isn’t fully decentralized today, so Ripple can be considered a full-fledged digital coin, though it’s more a payment system for banks and corporate clients than a currency for individuals.

Market capitalization and prospects

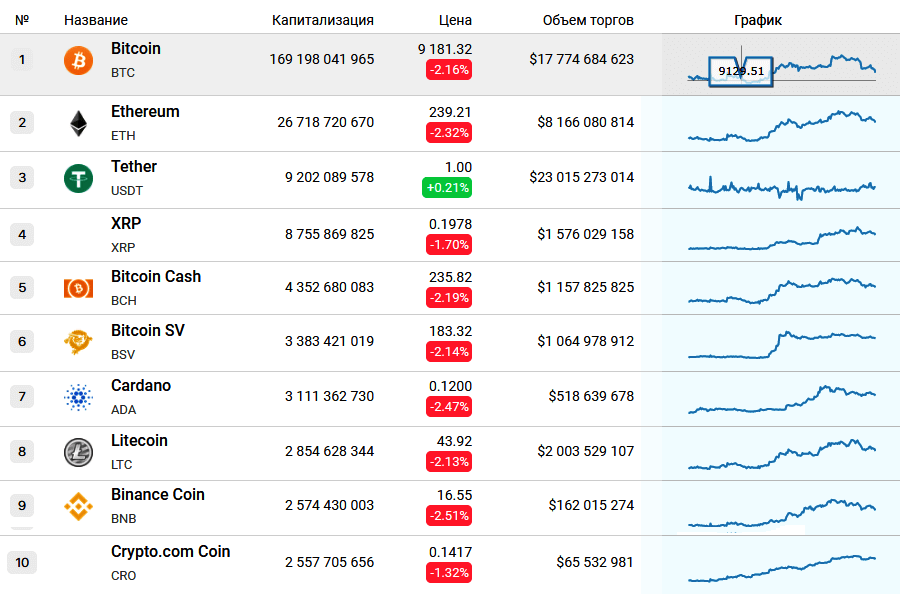

On the chart — the TOP-10 currencies by market cap as of July 10, 2020:

It’s obvious even without further explanation that no other competitors can match the first place, even combined. Despite Bitcoin’s sharp fall from a record $20,000 to the current price, the gap is still widening. The main reason is well known: futures are listed on the Chicago Mercantile Exchange (CME). This is the only cryptocurrency recognized by exchange investors and traders as a full-fledged trading asset, and until the situation changes, the market share won’t be challenged.

The price of 1 BTC — is a very high entry threshold, not only in Russia but also for foreign investors. At the same time, Altcoins with low coin prices allow starting to generate income with small investments, but it’s important to remember:

- The entire crypto market, albeit belatedly, always follows Bitcoin. Except for Tether, whose value depends only on current dollar positions.

- You need to decide what type of income you want to receive: quick speculative or moderate medium- and long-term. Intraday fluctuations of 15-20% are not unusual in our case, and you can buy and “catch the wave” for good earnings. But this trading style requires confident experience, and beginners may lose everything in such situations;

- For long-term investments, look at the combination of market cap / price per coin / trading volume; as an example, Litecoin. What do we see? Small market cap, affordable coin price, and low daily turnover. This indicates that owners are not very interested in sharp price movements and lack resources for that. At the same time, the rate shows steady growth — a typical “calm harbor” on the currency market and “blue chips” on the stock market.

- Carefully check news about new coins, especially if they are promoted in messenger channels with gradually increasing expectations of imminent profit. In 99% of cases, it’s pure speculation, and after the founders take the “cream” from a sharp fall or rise in price, the project will disappear forever.

Summary.

And what is the outcome?

We examined in detail what altcoins are; they can be considered as a fully independent means of payment or a trading asset. In the next 1-2 years, they are unlikely to compete with Bitcoin in terms of price or widespread adoption. These two factors prevent them from being suitable for long-term investments. But for speculative quick gains, suitable options can be found.