People who want to take someone else’s assets instead of earning their own appeared simultaneously with money. Digital coins have also become a subject of intense hacker attention, and the issue of protecting crypto investments has become critically important.

Only the official daily turnover is constantly increasing, approaching $1 billion. User anonymity is wonderful, but let’s remind you of the danger: when access to keys is lost, it cannot be restored. The result? Hackers calmly transfer stolen funds to themselves. Complete protection exists only in theory, but you can follow simple rules to avoid losing your cryptocurrency.

So…

Conversion Risk

News about hacks of crypto exchanges with assets disappearing in unknown directions appear with frightening regularity, but the most risky action on the crypto market remains the exchange or conversion into fiat money. When a third party guarantees the correctness of the payment processing — a bank or payment system like VISA/MasterCard — it’s much harder to manipulate data because they are real, not anonymous. This fact causes the greatest indignation among digital money supporters, and to bypass this, a new “trust” mechanism was invented using the blockchain.

In reality, this approach does not affect the level of payment security in the network. It’s good when everyone can verify the transaction’s correctness by opening the blockchain — the information is stored openly. But that’s where it ends — parties are anonymous, meaning if problems arise, claims cannot be made. Imagine you paid online without knowing who the seller is and where to get the goods. Not very good, right?

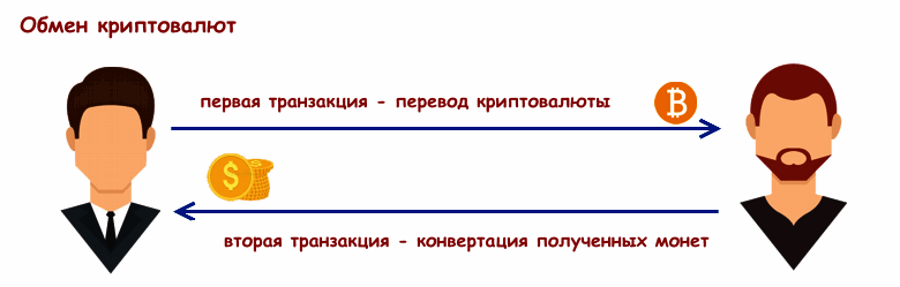

Then the question: how do digital money exchanges and conversions happen? The answer is simple: the sender, by default, must show greater trust by making the first anonymous payment. Then the recipient performs the agreed operation, closing the deal.

How can theft be possible in such a scheme? It’s obvious at first glance — the recipient simply disappears, taking the received coins. Next, people start writing on websites and forums. A scammer’s wallet is blacklisted — but that’s pointless, as they open a new wallet for repeated schemes. To prevent this, do the following:

- Carefully analyze private exchange offers on forums. Don’t think that all are scammers; there are quite reliable intermediaries, but it’s useful to check their history and read reviews before agreeing!

When real money is needed, use only bank transfers. No personal meetings for cash transfer, especially when you meet the person for the first time! Now everyone knows (thanks to the media!) that Bitcoin is worth about $10,000, and criminals even more so.

- Large sums should only be transferred through trusted exchange points or crypto exchanges. The latter is the longest but the cheapest in fees. For regular operations, do not use exchanges: they are primarily trading platforms, not exchanges. Such actions can lead to account blocking for rule violations, sometimes without refund.

- If everything goes smoothly with your current exchange, do not switch to another, even if their fee is 0.5% lower. This is one of the main ways to protect against losses. Monitor newcomers for at least 3-4 months (scammers usually close quickly), and withdraw a few small amounts before making a decision to switch.

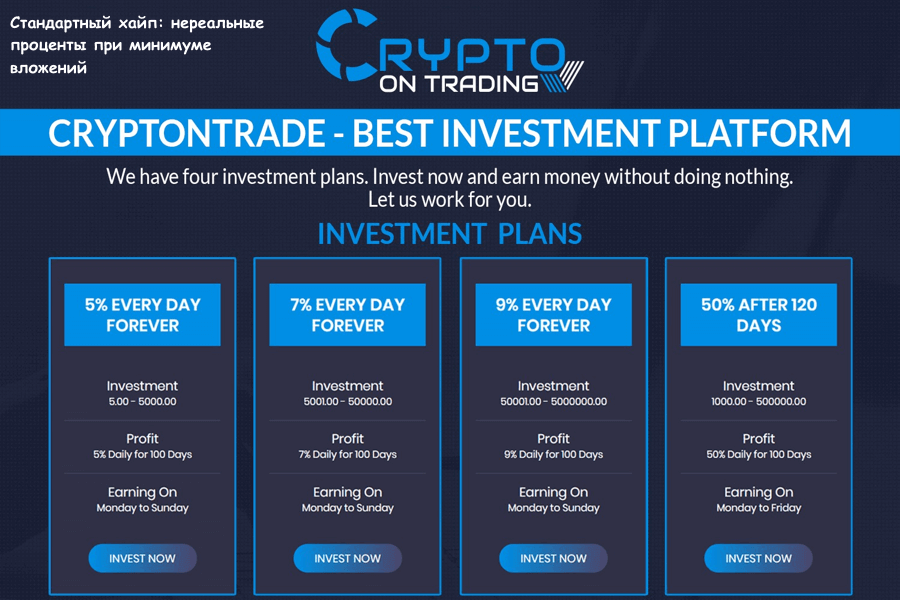

Cryptocurrency Pyramids

This is not about the ICO (initial coin offering) investment model, which will be discussed later in the article, but about projects that immediately aim to quickly gather as much money as possible and disappear with it forever. They are also called “hypes.” The number of deceived investors reaches hundreds of thousands, but the “Ponzi scheme,” where huge interest is paid initially from fresh money, probably will never disappear, continuing to attract new victims.

My simple advice on how to preserve your cryptocurrency: do not consider yourself smarter than the hype creators, hoping to “jump off” with accumulated interest in time.

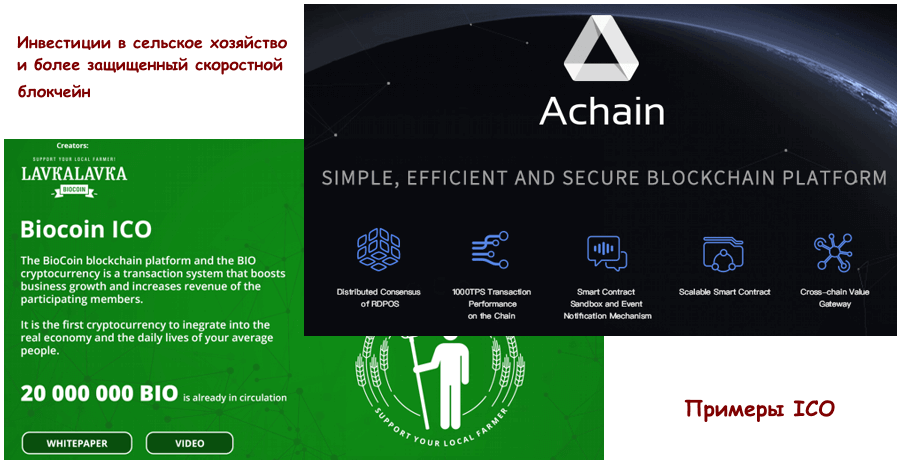

ICO Investment Projects

The ease of exchanging cryptocurrency or real (fiat) money into digital tokens that give a share of profits has led to a real “ICO boom.” Hundreds of new proposals daily, huge percentages (like in hypes!), intrusive advertising on specialized sites and blogs — all this actively dulls vigilance. If you are not a professional investor, relying solely on emotions can lead to wrong decisions.

The flip side of the ease of launch is a large number of unprofitable or outright fraudulent projects. But unlike pyramids and hype schemes where the probability of losing everything is 100%, it’s still possible to find a profitable and promising ICO. The main rules are:

- Refrain from investing if you don’t clearly understand what the project will do after the ICO. Adding the term “blockchain” does not add value but looks good in advertising and papers. If you don’t understand the phrase “a new word in creating private sidechains on a universal platform,” it’s better to pass and find a less profitable but understandable option. Also, safer investments are in additional ICO rounds — this indicates the project is developing, with initial investments already made and working.

- Check if the token is traded on exchanges or not. It’s a quite independent asset, and if traders are interested, you can try to earn on short-term deals.

Social Engineering Methods

Most people tend to painfully accept the fact that they are responsible for losing material assets because they do not follow basic security rules. When people leave doors open or forget keys in the ignition, talking about passwords for anonymous wallets is pointless. Sometimes they are stored on a computer or smartphone as plain text notes without encryption!

Mobile and online wallets are the most vulnerable, especially when payment data and confirmation go through external servers. If wireless access to the device is obtained, it’s quite possible to replace the transaction amount or recipient details. To reduce the risk, never make payments over public Wi-Fi networks!

It is also highly recommended to split your crypto holdings across multiple wallets, similar to how credit cards are used:

- Main wallet, containing most coins. Preferably a hardware (cold) wallet with hardware-level encryption. They have existed on the market for almost 10 years, and no confirmed cases of mass hacking have been reported so far.

- Operational wallet, to which the required amount is transferred before making a payment.

- If Bitcoin or other currencies are intended as long-term deposits expecting future growth, “paper” bills stored in a safe or bank deposit are an option.

A separate wallet is essential when it is published publicly, for example, on a charity site or for receiving payments for goods and services. Funds from it should regularly be transferred to the main wallet with enhanced protection. Lost anonymity is not the main problem; the main risk is that you can be clearly linked to a specific wallet, enabling targeted attacks.

And one last tip…

When thinking about how not to lose your cryptocurrency, do not forget to install and keep an up-to-date antivirus with a firewall, and filter internet connections against hacking attempts. It would be foolish to lose access to tokens and coins due to neglecting such simple procedures.

Wishing everyone reliable protection and profits!