Money — an important stage in human development as a person and as a member of society. Currency has come a long way from the form of “exchange” to a “means of payments,” and now blockchain and tokens have become part of everyday life.

Today, money is almost no longer physical; plastic cards have practically replaced cash. Naturally, the extreme option appeared in the form of fully digital money (engl. cryptocurrencies). At first glance, it seems complicated, but we will try to explain how cryptocurrency works in simple words.

History and Features

For most people, “digital money” is associated only with Bitcoin (engl. Bitcoin), but that’s not entirely true. The first theoretical developments of what we now call cryptocurrencies appeared long before the first BTC. The technology of “blind signatures,” where both participants in a transaction remain anonymous, and storing transactions in an unchangeable form in a database (the blockchain mechanism) are first mentioned in works by David Chaum, Adam Beck, and Nick Saboe from 1983-1997.

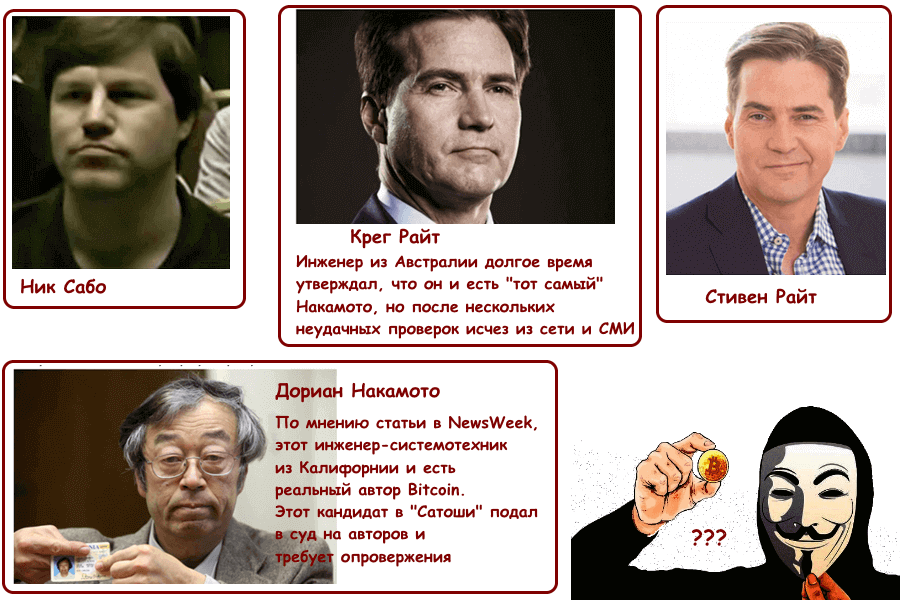

The transformation from theory to practice occurred in October 2008 after the publication of an online article “Bitcoin, as digital peer-to-peer cash” by an entity called “Satoshi Nakamoto.” He was the first to solve the main problems of anonymous currency: counterfeiting coins and double spending. Reuse of monetary units is impossible when using blockchain, and each new coin must have a unique hash code. The author chose to remain anonymous and delegated further development of the payment system to a non-profit organization, Bitcoin Foundation. Since the publication, many attempts have been made to find out who exactly “Nakamoto” is, but to no avail.

How does it work?

Those interested in the technical details of cryptocurrencies can search for more information online, but for “beginners” it’s enough to know (and understand!) a few basic principles:

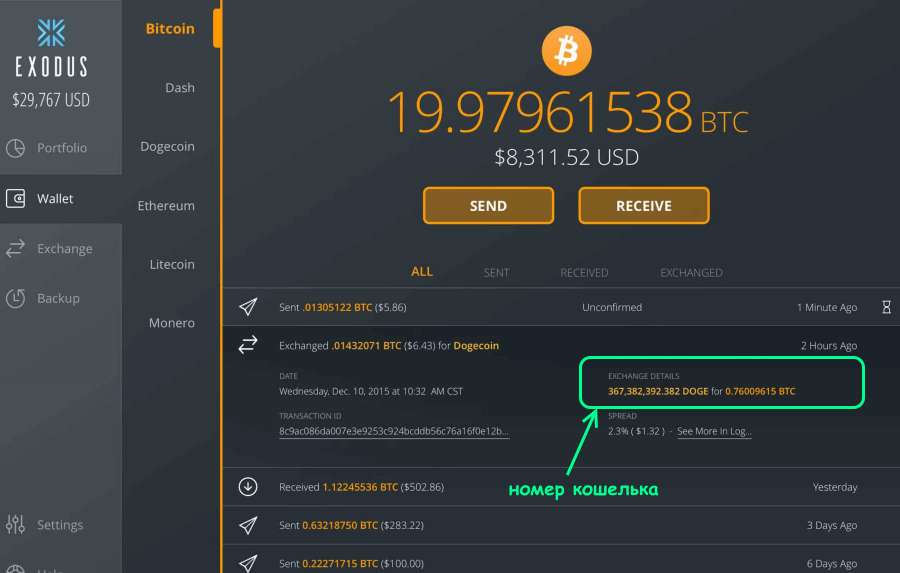

- Full anonymity of financial transactions is maintained. Unlike opening a bank account, which requires providing more and more personal data and keeping it up to date, opening a cryptocurrency wallet doesn’t even require an email; just install the app, top up the balance, and start making payments right away. The only problem with complete confidentiality is the inability to cancel a mistaken payment.

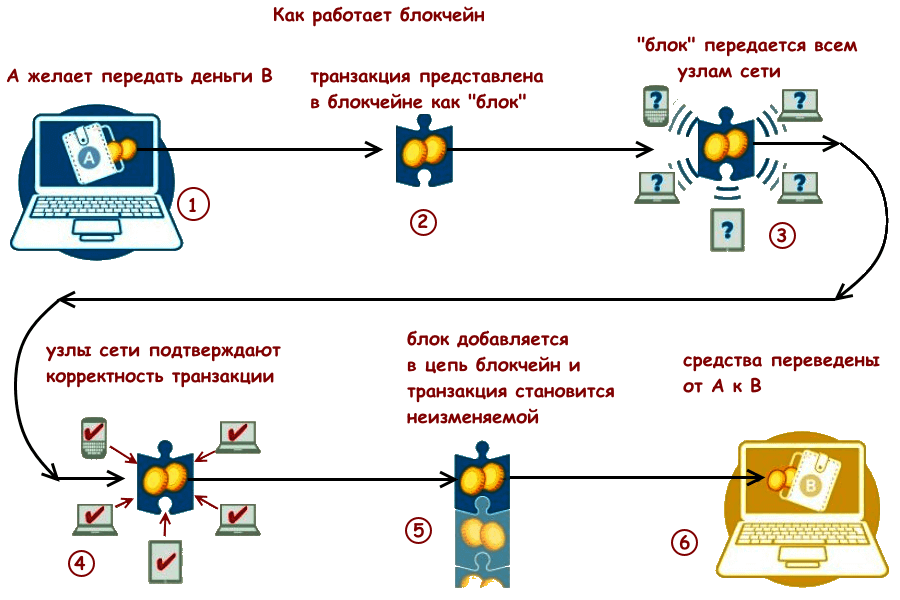

- The payment system has no central settlement or emission center. A wallet (except for online and mobile versions) functions as a full network node and contains a complete copy of the blockchain from the first transaction. This approach guarantees 100% system operability — the failure of one or several nodes is not critical. Unlike “classic” payment systems such as SWIFT and Visa/MasterCard.

- The blockchain guarantees immutability of financial information. It’s impossible to alter completed transactions “retrospectively,” which excludes double spending. A node (wallet) stores a full (or most) database, with open access for viewing. According to Nakamoto, this should increase the security of the payment network, but it’s a controversial issue.

Now, knowing the basic principles, we can give a definition of what “digital money” is:

Cryptocurrency (digital cash/currency/money) — is an anonymous means of payment for goods and services based on cryptographic algorithms, without a tangible equivalent. The issuance of monetary units (emission) is not controlled by banks or government structures. Cryptocurrency notes can be exchanged for real (fiat) money at an agreed-upon rate.

Where does cryptocurrency come from?

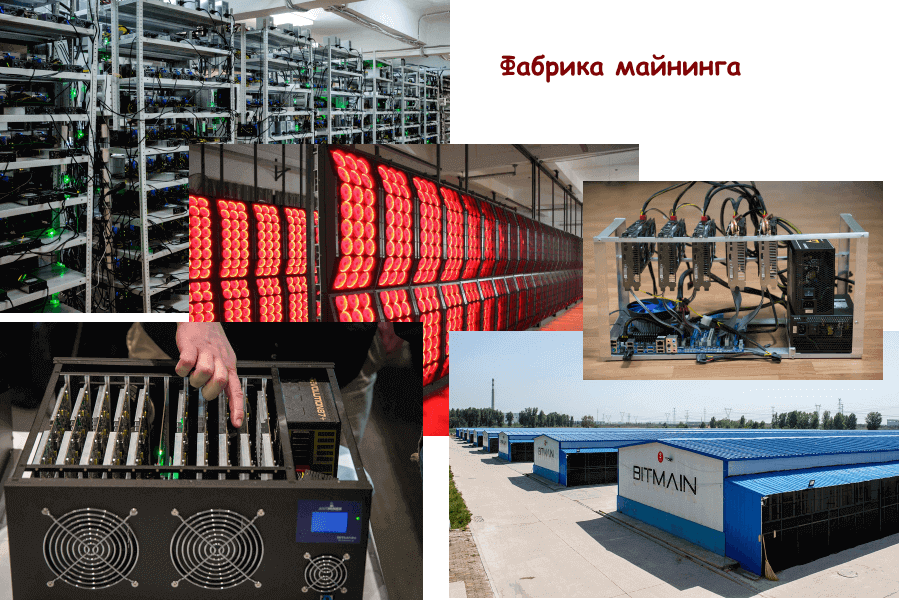

After reading the previous paragraph, a natural question arises — if there is no central emission, where do new coins come from? The answer: through mining or “extraction,” which creates new unique hash codes (blocks) to confirm transfers. For each new code, a reward is paid in the relevant digital currency, which can later be exchanged for real money, thus providing a clear income.

If you decide to create new coins, note that all types of cryptocurrencies are divided into two groups:

- Maximum total coin supply is limited (thus controlling inflation), but they are generated (mined) gradually, requiring increasing computational power to find the next block. This scheme is used by Bitcoin and its clones such as Litecoin, as well as Ethereum.

- All coins are issued in advance, stored in the blockchain, and controlled by a few developers or a non-profit organization. To receive rewards, users must run a transaction confirmation node (a “full node”), and the more transactions, the higher the profit. This is how Ripple, Peercoin, and many other currencies operate in recent years.

Competing with “mining factories” to get a new Bitcoin is impossible for an average user. It’s better to allocate a dedicated computer as a “node” and get a smaller but steady income.

How to get and spend?

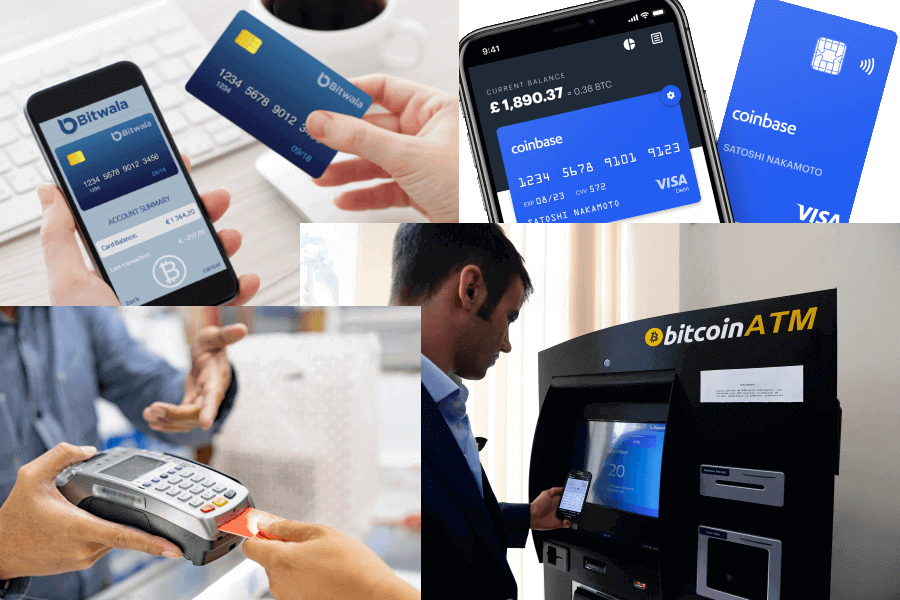

You can top up your wallet via online money exchangers or specialized services, where you can even get a Visa/Mastercard plastic card for cash withdrawals and cashless payments. Major currencies are supported by all large freelance exchanges, which can be advantageous for tax planning.

How to spend digital money? There are enough offers online—from access to gaming services and electronic services to delivery of real goods. However, in the latter case, you need to specify the recipient’s details, which reduces confidentiality but may be acceptable for some users.

How to earn?

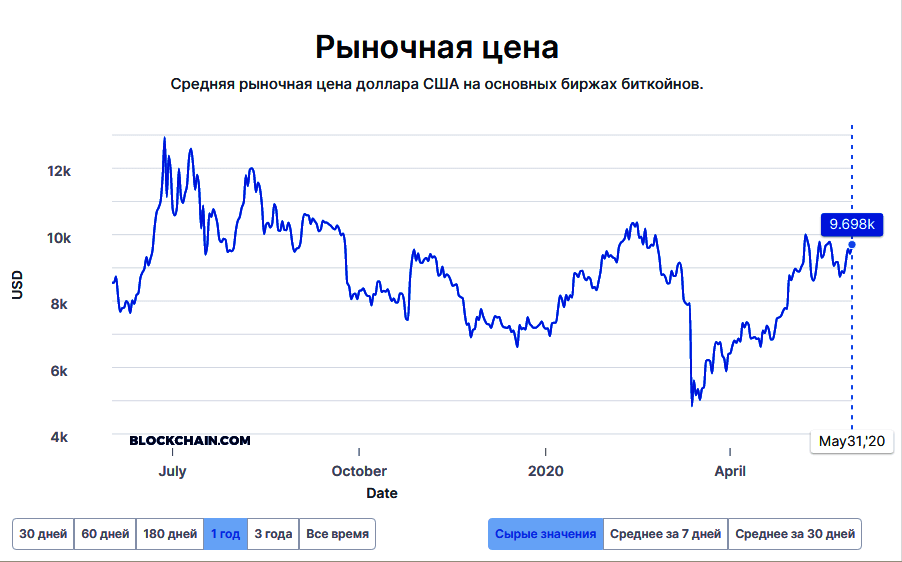

If you’re not into mining, the simplest way is to buy digital coins, wait for their value to increase, and sell at the peak. Many investors did just that in December 2017, when the Chicago Mercantile Exchange listed Bitcoin futures (you can track the price dynamics here).

During the peak frenzy, the price reached $20,000 per Bitcoin futures, then sharply collapsed, and the price never returned to that level, remaining around $9,500–$10,000. Of course, that’s still a lot, but at the “bottom,” the quote fell to $4,500–$5,000, causing huge losses to many investors.

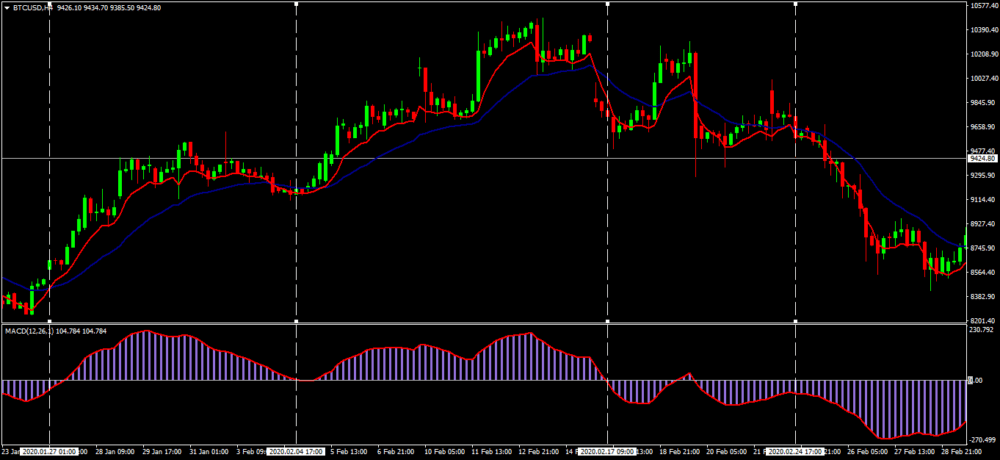

For professional traders and financiers, this market behavior is quite understandable. When an asset is not connected to the real economy and its price is driven only by reviews and human “optimism,” a 20-30% increase or decrease per month seems quite natural. They profit from price movements, and they managed to do it twice: when the price was rising and when it was falling fast. Moreover, almost all cryptocurrencies’ movements are well-replicated by proven technical analysis models.

Other ways to generate income include two more methods:

- Exchange arbitrage. Unlike centralized stock and even currency markets—which, despite lacking a single clearing center, maintain quote balance—cryptocurrency trading platforms are fully independent. This means that the price difference for the same Bitcoin can be enough to generate profit solely from buy/sell operations—almost “passively.” The only requirements are a large deposit, constant monitoring of rates, and quick reaction to changes.

- Investment in crypto funds and projects ICO (Initial Coin Offering). Both options involve an investor exchanging funds for digital “tokens,” which are similar to shares or stakes in companies. Then, dividends are paid on those tokens or they are traded on exchanges. As statistics from the last 2-3 years show, most such projects turned out to be simple financial pyramids. Only the most daring with extra funds should consider investing in them.

Is it legal?

This question should be considered as follows: the legality of issuing (mining), owning, and circulating (means of payment) cryptocurrencies.

Starting with mining: in almost all countries, earning digital coins during mining and storing them does not have negative legal consequences for owners, as it’s done, for example, in Russia. Non-commercial transfers between wallets and conversion into fiat are also permitted (though this depends on the specific country; in general, the situation is positive).

The situation with the means of payment is more complicated. The European Union, Japan, and Hong Kong permit the use of cryptocurrencies in commercial circulation, unlike the USA, where they are equated with securities, requiring a special license for buying/selling. In 2020, this became an insurmountable obstacle for the release of Telegram’s Gram (TRON) currency. Developers could not reach legal consensus with the U.S. Securities and Exchange Commission (SEC), and the project had to be discontinued. Similar regulatory issues are faced by Facebook with its Libra currency.

If we leave aside the slogans of supporters of anonymous payments about “a conspiracy of the global financial system against a bright future,” it must be recognized that the main obstacle for official recognition of digital currencies is precisely anonymity. First, the example of the Silk Road illegal goods store shows how hard it is to verify the legality of funds and identify owners of such platforms. Second, if both sides of a deal are unknown, how can the rights of consumers of goods and services be protected from fraud? Therefore, significant progress in this direction is unlikely in the near future.

And what’s the result?

We have examined how cryptocurrencies work in simple words, and once again ask: can you make money on them? Yes, it’s possible if you do not treat this asset as a store of wealth like a bank deposit. The income can only be obtained through trading — trading on volatility, engaging in interbank arbitrage if your funds allow, and you can earn more than on Forex or stock markets.