In the world of cryptocurrencies, the prospects of hard forks and soft forks have always been the subject of intense discussions among experts, traders, and ordinary coin holders. Cryptocurrency exchange users love hard forks because they offer the opportunity to replenish their accounts with a relevant amount of new coins created as a result of blockchain branching. Fork creators aim to improve the system and eliminate flaws that reduce its efficiency.

Problems can arise when community opinions are divided, and some users decide to stick to the old rules.

In this article, we explain in simple terms what a hard fork and a soft fork are, and why there is such a fuss around these events.

What is a cryptocurrency fork?

The foundation of cryptocurrency is based on blockchain technology — a chain of blocks storing information about all transactions that occur within the system. All data in the blocks is encrypted using cryptography. Since any cryptocurrency has open source code, developers can use it at their discretion — copy or modify it.

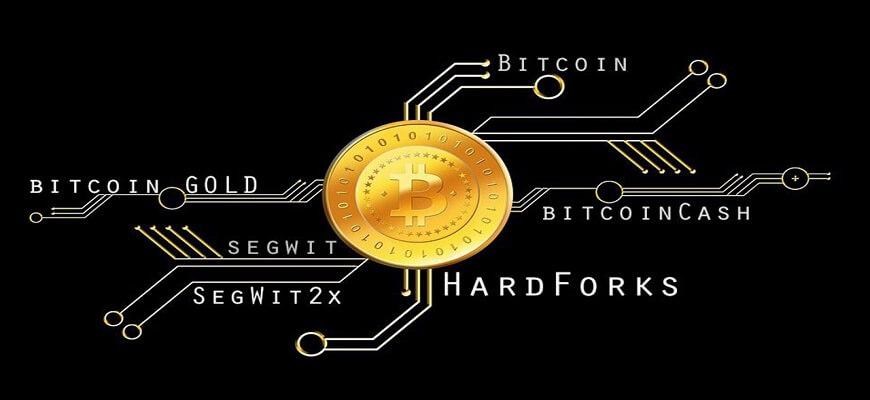

Changing the source code of a digital currency is called a fork (from the English “fork” — a fork). During this process, the continuous chain of blocks splits into two branches, which begin to operate independently.

Branches can also occur each time two miners find the key to a block almost simultaneously. In the future, subsequent blocks are added to the current one — the longer chain wins, and the shorter one is rejected by the network.

Forks are divided into hard forks and soft forks.

Hard fork in action: causes and consequences

A hard fork (maximum radical and irreversible splitting of the blockchain) occurs when a block that adheres to the old algorithm is not accepted under new rules. If, during a hard fork, the cryptocurrency community decides to follow the new protocol, then from the moment of the split, the chain corresponding to the old rules ceases to function, and the blockchain continues to exist in a single form.

When community opinions are divided, the network continues to operate with two branches and a shared transaction history; that is, two cryptocurrencies begin to exist, each with its own blockchain.

There are many examples of hard splits in the crypto environment. The most famous are Ethereum Classic, which was formed as a result of the Ethereum hard fork, and Bitcoin Cash, which was a significant event in Bitcoin’s history of division.

The main reason for hard forks is the need to improve technology. Usually, developers aim to increase block capacity and reduce transaction fees. For example, in the Bitcoin hard fork, the Bitcoin Cash block size increased from 1 to 8 MB, and a mechanism was implemented to protect against transactions on a parallel chain.

Advantages of branching also include the elimination of defects that slow down platform performance and the growth of user capital due to the addition of a relevant amount of new network coins. A common consequence of a hard fork is the decrease in the currency’s price, caused by a sharp reduction in the number of users and miners.

Soft fork: concept and types

The main difference between a soft fork and a hard fork is its compatibility with the current algorithm and the ability to accept blocks created according to new rules.

A soft fork (soft fork) involves making minor changes to the blockchain to optimize certain functions of the cryptocurrency. Activation of a soft fork requires support from the majority of network participants controlling the main computational power. Otherwise, old network nodes will continue mining new blocks, but they will be rejected by nodes that have adopted the update.

A vivid example of a soft fork implementation is the adoption of the SegWit protocol in the Bitcoin network. As a result of changes to the block structure, the main cryptocurrency’s functionality was expanded with several features:

- The number of transactions per block increased, and accordingly, the reward for miners increased;

- The transaction fee decreased;

- The network’s throughput increased;

- The security system improved (multi-signatures appeared);

- The network was optimized through the implementation of Lightning Network and smart contracts.

Any protocol changes in cryptocurrency are possible only with miner support. However, in some cases, blockchain updates can be made without the main computational power’s participation. The UASF (User Activated Soft Fork) model allows individual network groups (exchanges, blockchain wallets) to independently set the date for the soft fork.

Implementing UASF requires long preparation and support from most major players. It was first used when implementing the SegWit protocol to increase transaction speed.

How to profit from forks

Investors and traders use cryptocurrency hard forks to increase capital by purchasing additional coins just before the split, expecting to receive new coins on their accounts.

Typically, after each successful “split,” the value of the currency begins to fall because those who bought coins before the event rush to sell them. Traders profit from the price decline of the cryptocurrency at the moment of division by opening short positions.

Often, before a hard fork of Bitcoin, when many investors transfer their assets to the main cryptocurrency, leading altcoins lose value.

Additionally, some players buy coins at a good discount, expecting a strong rise in altcoins immediately after the hard fork.