Cryptocurrencies or “digital money,” despite all the peaks and valleys of recent years, have still established themselves as a trading asset and a real alternative to the traditional financial system of cash and plastic cards. A new industry – new terms!

Like any new phenomenon, the world of digital currencies has its own language. Here is a brief dictionary – the top ten most essential crypto-terms, which will help you understand what you’re dealing with and how to use it.

- Cryptocurrency (engl. Cryptocurrency, digital cash/currency/money)

- Blockchain(engl. Blockchain, block chain)

- Bitcoin (engl. Bitcoin)

- Altcoin (from Engl. Altcoin, alternative coin)

- Fork (Engl. Fork – fork, branch)

- Mining (Engl. Mining)

- Cryptocurrency Wallet (Engl. Cryptocurrency wallet)

- Cryptocurrency Address (Engl. Cryptocurrency address)

- Smart Contract (Engl. Smart contract)

- ICO (Engl. Initial Coin Offering)

- Faucet (tap)

- Tokens (token)

- Arbitrage Trading (arbitrage trade)

- Airdrop

- Volatility

- Node

- Master Node

- Hard Fork

- Bucket

- Market Capitalization (Engl. capitalization)

- Scam (Engl. SCAM)

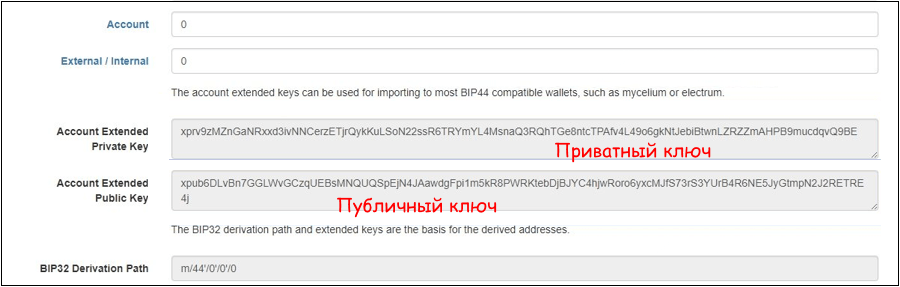

- Private Key (Engl. private key)

- Public Key (Engl. public key)

- Stablecoin (Engl. stablecoin)

- Hardware or “Cold” Wallet (Engl. cold wallet)

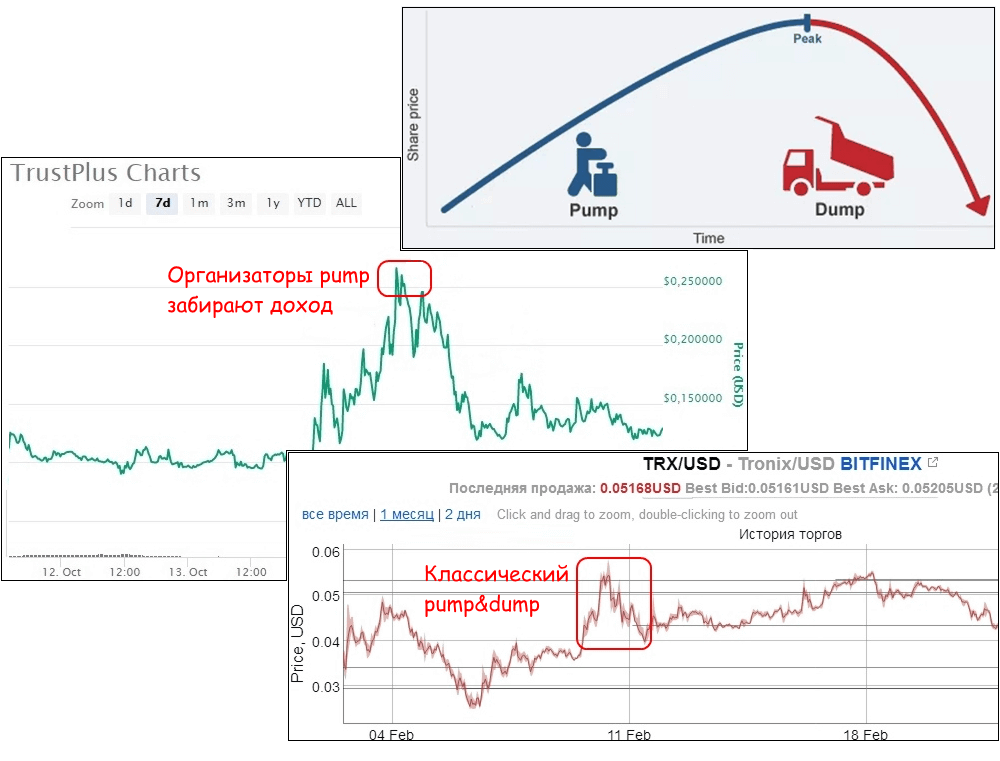

- Pump & Dump (Engl. Pump & Dump)

Cryptocurrency (engl. Cryptocurrency, digital cash/currency/money)

An anonymous means of payment for goods and services based on cryptographic algorithms, without a tangible equivalent. The issuance of monetary units (emission) is not controlled by any banking or government structures, neither legislative nor fiscal.

Digital monetary tokens can be exchanged for real (fiat) money at an agreed-upon exchange rate by the parties involved. Main features of cryptocurrency:

- All payments are completely anonymous. To get started, it’s enough to specify an e-mail and install wallet software. No other personal data is required!

- There is no central settlement or emission center. Decentralization of the network allows it to operate independently of the performance of any specific node – a failure is not a critical factor in conducting a payment.

- Once entered into the database, the information becomes immutable and is publicly accessible (see further the blockchain).

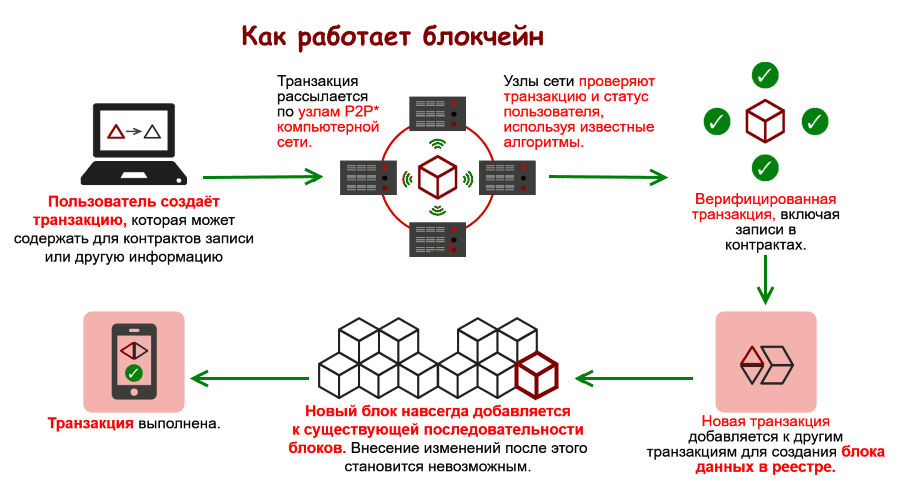

Blockchain (engl. Blockchain, block chain)

A decentralized database containing information about all user actions working on cryptocurrency principles since its inception. Immutability is ensured through unique hash codes and chains of blocks. Any data change triggers a re-calculation of the hash, quickly revealing forgery.

Initially, it was assumed that each node in the network holds a full copy of the blockchain, as Bitcoin does. However, the total size of the database constantly (and very rapidly!) increases, so to save disk space, it is sufficient to get data from the last 3-4 months. When a new transaction appears, all nodes synchronize, further protecting against unauthorized modifications.

Bitcoin (engl. Bitcoin)

The first practical implementation of the idea of a fully digital currency. The author is considered Satoshi Nakamoto, who published a series of articles in October 2008, solving two practical problems of cryptocurrencies: the impossibility of counterfeiting and double spending. Currently, it is the largest currency by market capitalization and the most widespread as a means of payment.

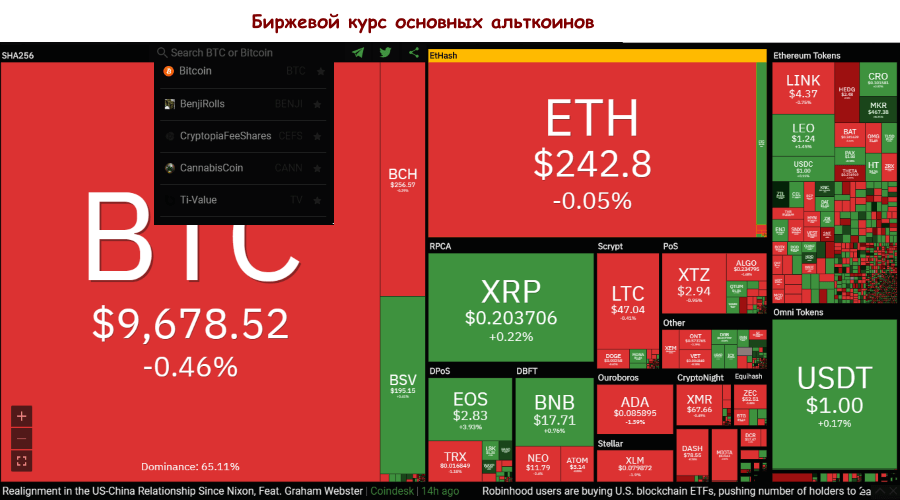

Altcoin (from Engl. Altcoin, alternative coin)

A general term for all forks of Bitcoin (see below). As of early 2020, there were over 2000 variants technically conforming to cryptocurrency standards. The term altcoin is also defined by Wikipedia in the same way:

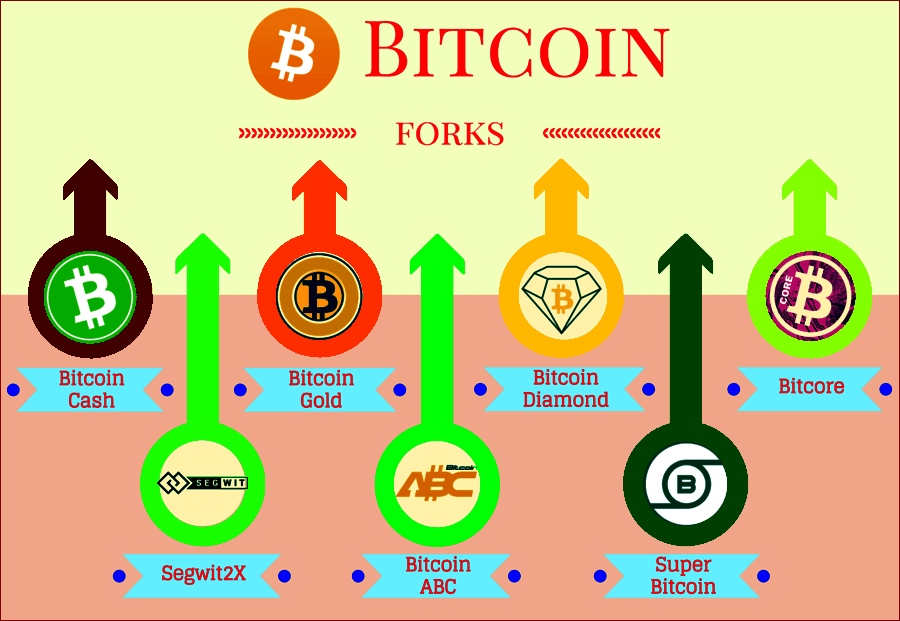

Fork (Engl. Fork – fork, branch)

Creating new coins based on an existing cryptocurrency. Almost all modern digital money are “clones” of open-source Bitcoin software. Main reasons for a fork include:

- Quality improvement of the “parent”. Example: increasing the block size in Bitcoin Cash for faster confirmation of transactions.

- Marketing. Forks of platforms like Ethereum immediately attract media and internet attention. The reason might also be to maintain market share or fix discovered bugs and vulnerabilities.

From a technical standpoint, creating a new currency is done as follows:

- Chains of the new currency are added to the general blockchain from a certain point. Compatibility with the previous version of wallets is maintained. An example of a “soft” fork is Litecoin.

- If changes are made to the original algorithm, compatibility is lost, and a new version of the blockchain and software is required. Example: a new version of Monero, which complicates mining on ASIC devices.

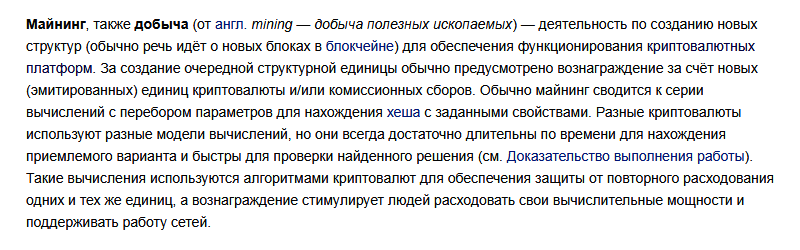

Mining (Engl. Mining)

Since cryptocurrencies do not have an emission center that adds new monetary units to the payment system as needed, this is done by independent participants or “miners.” Those interested in this process can easily find information online; in simple terms, you need to find a new unique hash or key that marks a block, containing a set of transactions. Transactions are confirmed by other nodes before being added to the blockchain. Here’s what Wikipedia says about it:

In simpler terms, think of a banknote with a unique serial number, passing from one owner to another. Two banknotes with the same number cannot exist, which is what miners ensure. For each new unique hash, the miner receives a reward from the network (in crypto!), which is their profit.

The next factor affecting the cost of mining is the algorithm used for confirming the uniqueness of a block:

- Proof Of Work (PoW) (proof of work). Miners are paid for the time spent finding a new block. This is how networks like Ethereum, Bitcoin, and their forks operate. The time to find a hash increases as the network difficulty grows.

- Proof Of Stake (PoS) (proof of stake). Used in currencies where all coins are already issued (PeerCoin, NEM, Ripple, etc.). Here, the “mining” of new coins depends on the number of confirmed transactions through a node containing the full blockchain or a “masternode.” Rewards are smaller than PoW but no large hardware investments are needed.

Cryptocurrency Wallet (Engl. Cryptocurrency wallet)

Software that allows making and confirming payments. Each crypto terminology dictionary classifies wallets differently, but they can be roughly divided into three groups:

- “Thick”. Contains a full copy of the blockchain or is a masternode (see above) in networks with pre-mined coins (all coins issued in advance). Main requirement: sufficient disk space for the database, which constantly grows.

- “Light”. No need to download the database; payments go through external confirmation centers (nodes) usually recommended by developers. Privacy risk increases, but there are no legal issues if it’s not illegal activity.

- Mobile or online wallets. Limited memory on smartphones and tablets leaves no choice but external confirmation. Such wallets include hardware wallets like Ledger or Trezor (brand names for example, not advertisements).

Cryptocurrency Address (Engl. Cryptocurrency address)

A unique identifier of a wallet in the network. Simply put, it’s similar to a mailing address or email, but with no way to identify the owner precisely. Each cryptocurrency has its own address structure; for example, Bitcoin addresses are 32(33) characters long, including Latin letters and digits in a unique sequence.

Addresses can be static (permanent for each transaction), or you can even order a custom one containing a brand or website address, or dynamic – unique for each new operation.

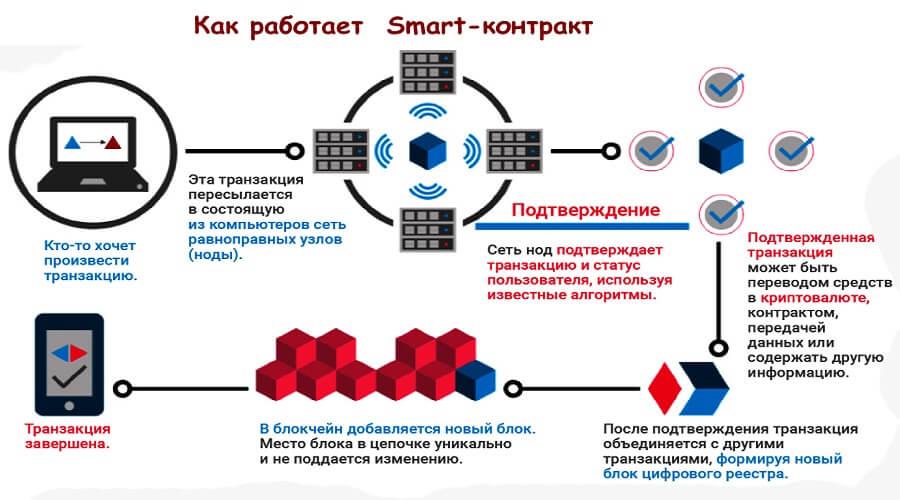

Smart Contract (Engl. Smart contract)

Designed for automatic execution of specific actions (money transfer, transfer of ownership rights, etc.) under predefined conditions. The transaction is considered valid when all conditions (or some mandatory ones by mutual agreement) are met.

Thus, human factor is completely eliminated, and storing information in the blockchain allows control over execution by the parties involved or a third party. The leading platform for smart contracts is Ethereum.

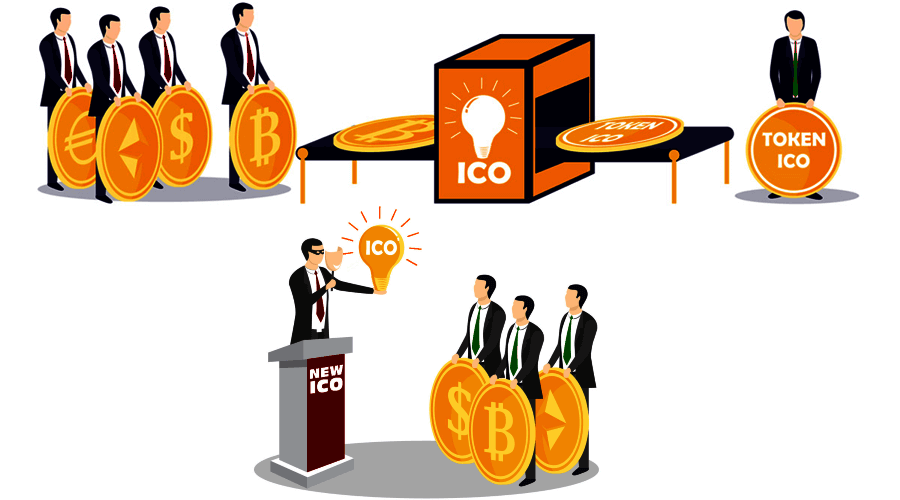

ICO (Engl. Initial Coin Offering)

A method of off-exchange attracting external investments by exchanging (selling) a pre-issued volume of coins or smart contracts at an agreed rate. The investor receives digital tokens, which are analogous to property rights. It’s similar to shares, which also serve as a tradable asset on the stock exchange.

Unfortunately, insufficient legal regulation of the crypto sector in most countries has led to many “default” fraudulent projects and discrediting the very concept of ICO, although this investment model has a long tradition of success. Tokens such as Status Network Token (SNT), EOS, and Bancor have allowed investors to recoup their investments and make good profits.

That’s not all! Stay with us – to be continued…

Crypto Terms Dictionary. Part 2.

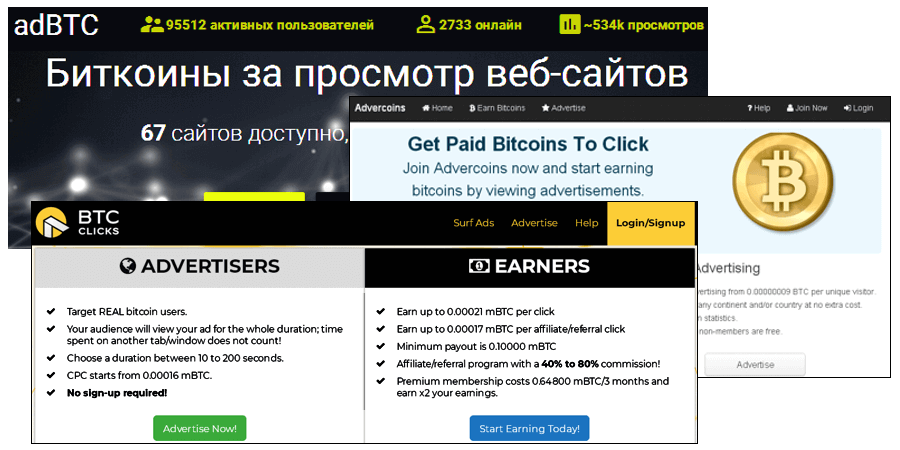

Faucet (tap)

A faucet is a website or page where you can receive a reward (bonus) in cryptocurrency for performing certain actions or viewing ads. Faucets most often pay bonuses of two types:

- Accumulating. The user’s balance increases periodically, even if no actions are performed. To get these bonuses, extended registration with personal data and consent to further processing and sale is usually required.

- Discrete. The reward is paid once for completed actions or spending time on the site (the longer, the bigger the bonus).

Tokens (token)

Tokens are electronic confirmation of rights of the owner for a share of profit, assets, or participation in company management. The first commercial implementations were smart contracts of the Ethereum platform, and they gained widespread use in ICO investment projects. Like regular shares, tokens can be transferred to another owner, traded on an exchange at market price, and have derivative financial instruments like futures and options.

Arbitrage Trading (arbitrage trade)

Arbitrage trading is a type of exchange trading aimed at making profit from price differences of an asset on different trading platforms. In the early stages of crypto exchanges, this approach was effective. The lack of liquidity exchange mechanisms, as in stock and forex markets, allowed setting quotes differing by dozens of dollars per coin. Thus, speculators profited simply from buy/sell operations, regardless of market direction. Now, quotes have leveled out, and arbitrage is only possible on large deposits and with the use of automated HFT-trading systems — otherwise, it’s hard to spot the opportunity in time and act quickly. Read more about types of arbitrage trading in Wikipedia, but not all arbitrage methods are applicable in crypto operations.

Airdrop

An airdrop is a distribution of digital coins or tokens for performing certain actions. Such actions include reposting articles, liking social media posts, or meeting specific recipient criteria (location, age, profession, etc.). Airdrops resemble bounty programs of ICO projects but have a different purpose: to generate maximum publicity for a new cryptocurrency, project, or software. They can be of several types:

- Automatic. Holders of coins receive new ones following a hard fork, as in the case of Bitcoin Cash. After network split, the new wallet balance equals the initial Bitcoin amount.

- Incentive. Coins are credited for actions like mailing, reposting, articles, supporting groups on social networks, etc.

- Premium. Coins are given only to those holding a certain amount of the currency. For example, to get Stellar for free, you need to have any amount in your Bitcoin wallet.

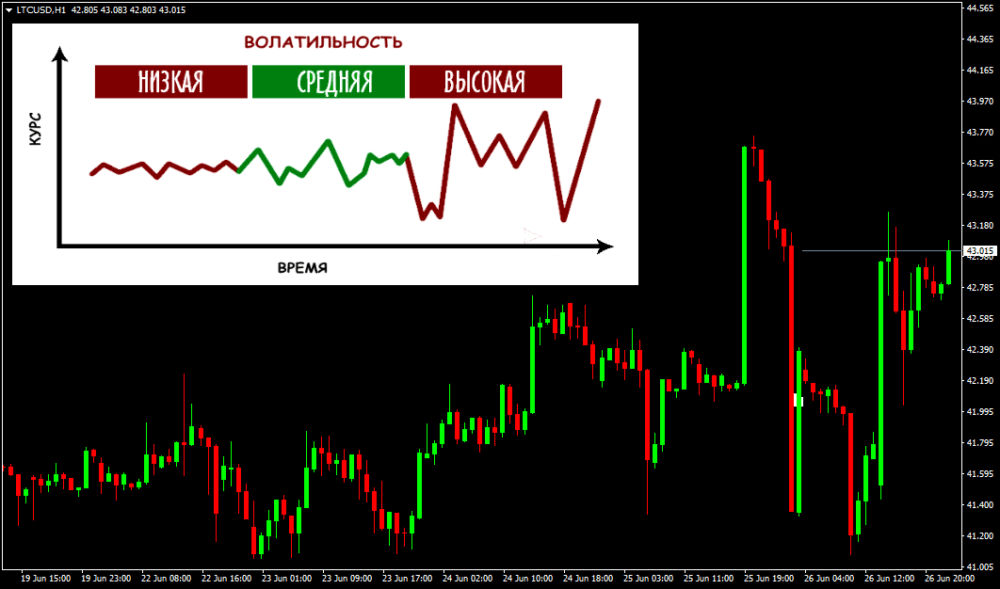

Volatility

Volatility is the range of price change of a financial asset over a certain period (day, week, month). In trading, it indicates how many points (not money!) the quote has moved during that period. Volatility can be:

- Historical (actual). The amount of price change over past periods.

- Potential (expected). Based on historical data, a forecast of future fluctuations is made. Remember, one of Dow’s principles states that “history repeats itself.” Long-term observations confirm this, regardless of the asset or market. But in cryptocurrencies, where volatility is especially high, additional confirming factors are needed. Price impulses here are mostly speculative, so forecast accuracy drops sharply.

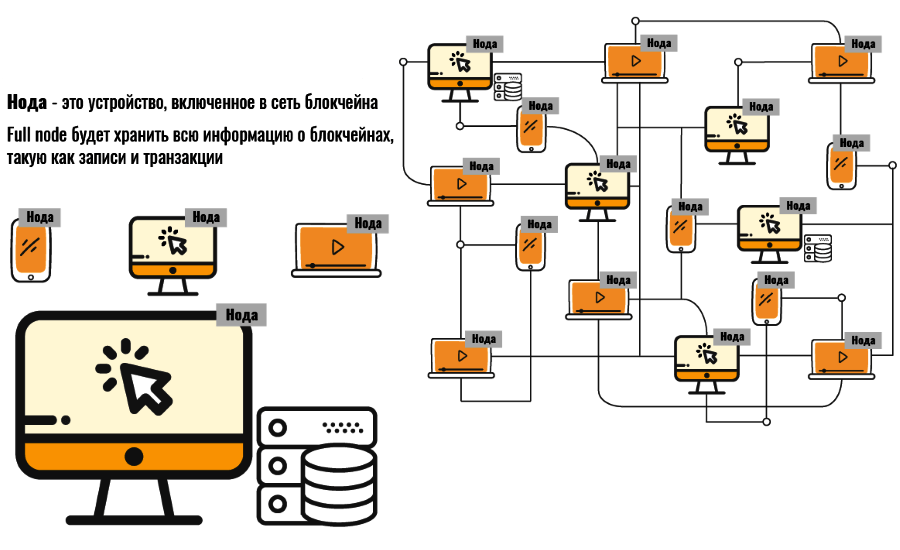

Node

A node is, simply put, a desktop computer or mobile device running software that provides access to the cryptocurrency network. The node performs three main tasks: confirming transactions (consensus), transmitting information across the network (updating wallet balances, etc.), and storing a full or partial copy of the transaction history (blockchain).

Depending on its purpose, nodes can be:

- Full. Stores a complete copy of the blockchain and participates in voting on protocol changes (fork).

- Pruned Full. Stores only data for a specified period, usually the last 3-5 months. Like full nodes, they can confirm transactions through a cryptocurrency wallet.

- Archival. Like full nodes, they contain the entire database but are divided into two types: with the ability to add new blocks and without.

- Mining. Nodes used for discovering new unique blocks.

- Staking. The more funds on the node’s wallet, the higher the probability it will be chosen to confirm a new transaction and receive a reward.

- Lightweight (SPV). Do not have a copy of the blockchain and confirm payments through full nodes. This is how online and “light” wallets work. Running a node doesn’t require much resources, but security is reduced.

- Lightning. Establishes a direct communication channel between users without using the blockchain. This improves speed but requires additional connection security and trust.

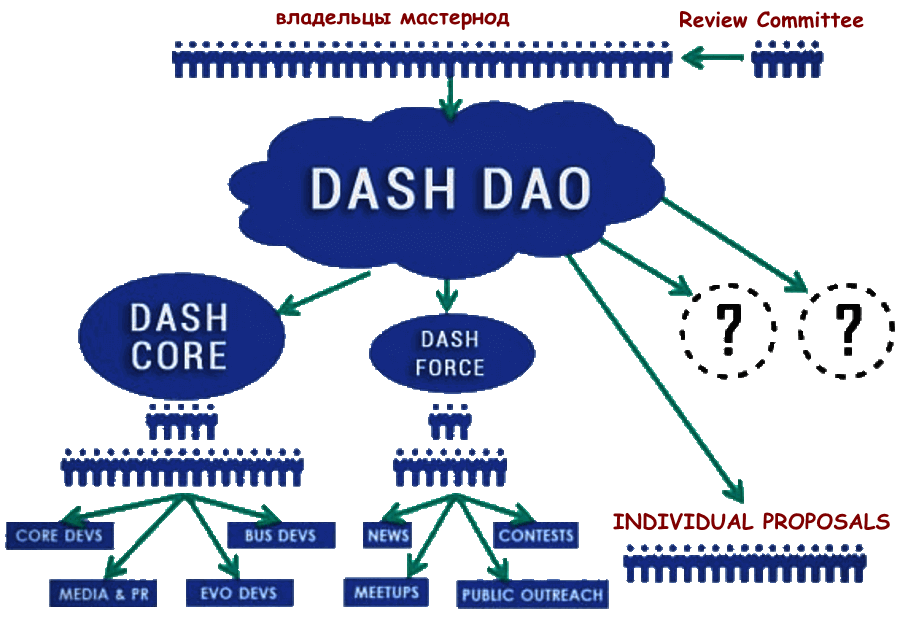

Master Node

In cryptocurrencies where all coins are pre-mined (proof-of-stake), a master node is a node that has the right to sign transactions. To obtain such a privileged position, one must maintain a certain balance in the wallet and keep the equipment running 24/7. The rating of active nodes increases, as does the reward size.

Hard Fork

A hard fork is a process of making incompatible changes to a cryptocurrency protocol. Unlike soft forks, it requires installing new wallet or mining node software. All hard fork cases can be divided into planned and forced. In the first case, the “disconnection” date is known in advance and approved by the majority of users. An example is Bitcoin Cash and its “parent” Bitcoin.

In the second case, developers are forced to release a new version of the protocol in response to external circumstances, such as Ethereum after the DAO hack or Monero’s more complex algorithm to prevent ASIC mining.

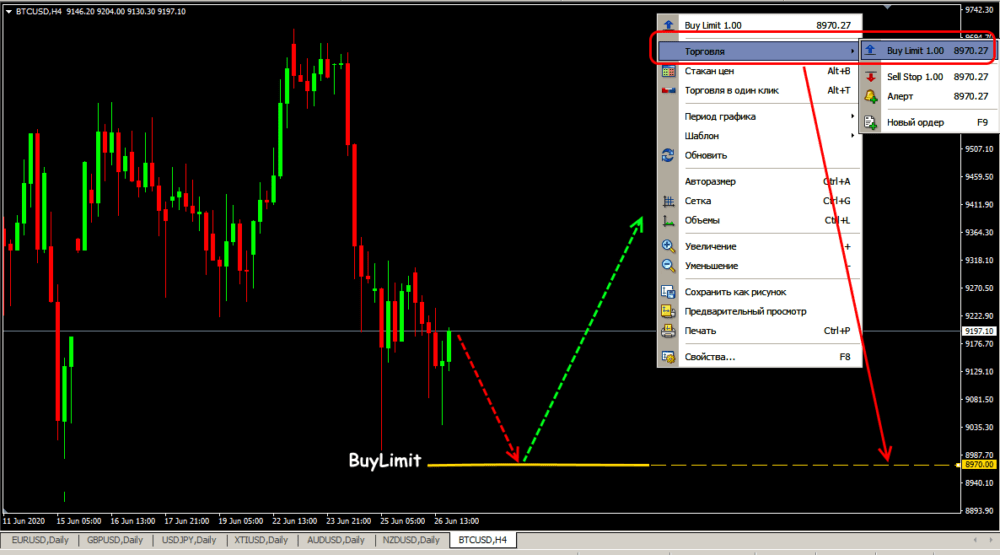

Bucket

In exchange slang, it means placing a BuyLimit order below the current price. The trader assumes that after the market drops to this level (“bucket” filled), the upward trend will resume, and a buy order will automatically open. It is placed below the current market price.

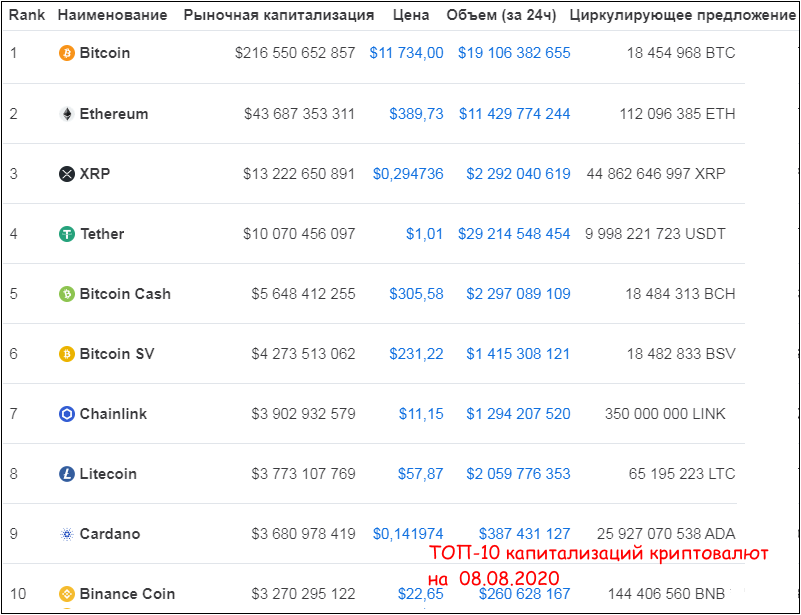

Market Capitalization (Engl. capitalization)

The total value of a cryptocurrency in other digital currencies or real (fiat) money. Calculated as “circulating supply × current price”. It’s important to understand that the calculation only considers coins in free (exchange) circulation and does not account for those actually stored in “passive” states. For example, at least 10,000 BTC are held on a wallet linked to Bitcoin’s creator Satoshi Nakamoto and have never been used for payments or transfers. Such “reserves” can be used to quickly influence quotes and thus capitalization in favor of large players.

Scam (Engl. SCAM)

The general term for crypto projects whose main goal is to gather as much client funds as possible under an attractive idea and then disappear with the money.

Besides classic financial pyramids or “hypes” promising huge percentages in a short time, scams can disguise themselves as interesting ICO ideas or even charitable projects. The quality of current scams is very high, and detecting such sites requires prudence and reading reviews on websites and forums.

Private Key (Engl. private key)

A unique alphanumeric combination used to access a cryptocurrency wallet balance. With the private key, the user confirms ownership of the digital coins and the correctness of the transfer. After signing a transaction with the private key, it becomes irreversible, enters the network, and is recorded in the blockchain. In case of loss, it is impossible to recover the private key, as well as access to the wallet!

Public Key (Engl. public key)

An identifier of a user (wallet) for recording transactions in the blockchain. It is generated based on the private key and is publicly accessible. One-time public keys can be created for each transaction.

Stablecoin (Engl. stablecoin)

Developers claim that such cryptocurrencies are backed by “real” assets. The first was Tether, whose rate is 1:1 to the US dollar. But where the “real” dollars are stored and how many there are is still unclear. For more details on what a stablecoin is, read Wikipedia.

Hardware or “Cold” Wallet (Engl. cold wallet)

An external USB or HDD storage device where the crypto wallet data is stored. It allows working from any computer and internet access point:

- This is not a portable wallet. All data is stored on the external device, and in the case of a cold wallet, hardware encryption is used as an addition to standard login and password. This increases security, and no confirmed cases of hacking by leading market players like Ledger have been reported so far.

- The size of the medium does not allow it to store a full copy of the blockchain, especially when using multiple currencies simultaneously. Confirmation is done through the hardware wallet’s servers, and as mentioned, there have been no serious hacks reported.

Pump & Dump (Engl. Pump & Dump)

A classic stock market speculation: owners of a large amount of a trading asset, in our case cryptocurrency, begin to raise the price by spreading information hype via media, websites, and messaging channels like Telegram. When most small players buy in, the organizers sell at the peak, taking profits, and the quote sharply drops. Such schemes are most common with pre-mined coins, where all coins are issued in advance, but can also involve pump mining, where large amounts of crypto are rapidly generated and dumped onto the market at a specific time. Examples of pump & dump: