A decentralized and, most importantly, immutable database — often called blockchain — was long considered applicable only in cryptocurrencies for storing transaction history. But this is just one of the application options for this new technology.

New ideas clearly pointed to smart contracts (“smart” by name). They can be used to implement secure systems for accounting, document flow, government registers, etc. They are also used in investment projects based on the ICO (initial coin offering) model, which involves tokens in cryptocurrencies. Let’s start with definitions.

Who is a token?

Immediately, readers should note that the concept “token = cryptocurrency” is not entirely accurate. Yes, both assets exist only in electronic form and can be obtained through the sale/purchase of goods and services, as well as actions not directly related to economics, such as bonuses, prizes, and others. At first glance, issuing and selling tokens is no different from cryptocurrencies, but in reality, they are closer to transferring ownership rights (as first implemented on the Ethereum platform) than to digital money.

If tokens are not money, then why are they so widely used? As always, programmers and marketing departments complicate what can be explained simply:

It’s the same as shares or other rights to a part of a company’s assets or income. They can be sold, transferred ownership to other owners at a market or agreed price and conditions. They can be traded on exchanges, have derivative instruments (futures and derivatives), just like Bitcoin.

What can you buy with tokens?

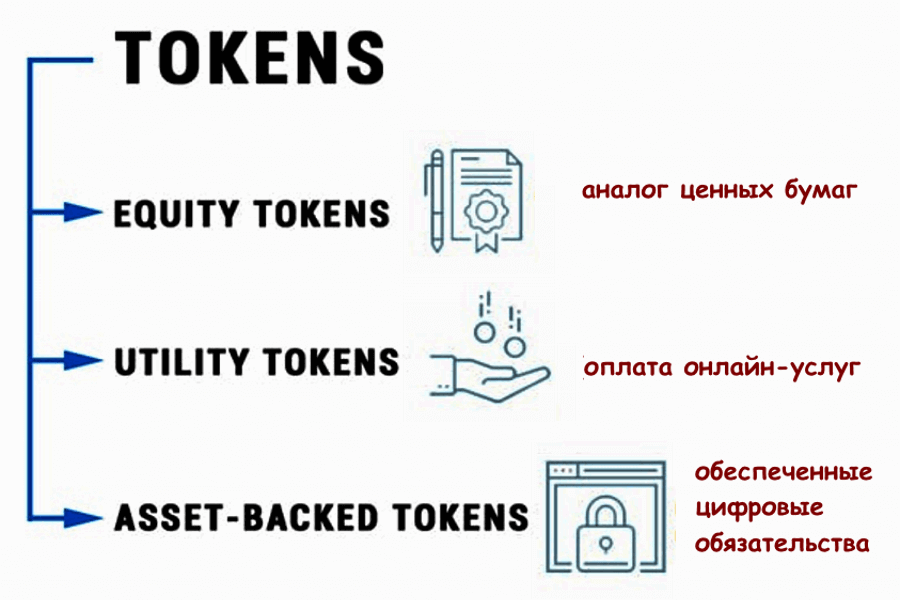

Let’s look at what types of these “virtual assets” exist:

- Analogues of securities (Equity tokens). Like regular shares, they give the owner the right to influence the development of the company or receive dividends from profits. This is how the stock market works, where the “rights” of investors are determined by the amount of invested funds and the type of share (ordinary, blocking, etc.). The fact that such phenomena are often absent in ICOs understandably causes concern among investors about their invested funds. But there are options where the majority token holder still has the right to influence decisions, but this requires knowing the real personal data of the project’s founders.

This category also includes sites offering direct (P2P) loans, where wallet owners lend or receive funds with subsequent data storage on the blockchain. This avoids strict bank requirements, but on the other hand, recording in a database does not constitute a legal obligation. Therefore, there is always a risk of losing trust.

- Payment for services or rewards for actions (utility tokens). Applications and services can award bonuses to users. Examples include points that can be used for in-game purchases or in online stores. Sometimes, compensation in real money (like in plastic cards) is not available, and cryptocurrencies can be a good alternative. The Bitcoin source code considered this option but did not develop it, and now this market is fully dominated by Ethereum-based solutions.

- Confirmed digital obligations (asset-backed tokens). Here, the share is backed by real assets (kilograms, man-hours, electricity consumption) and can be the subject of legal disputes or used for paying for goods or services. In 2020, the growth of such projects was expected, as fully “digital” ICOs no longer attract serious investors and funds.

Where do tokens come from?

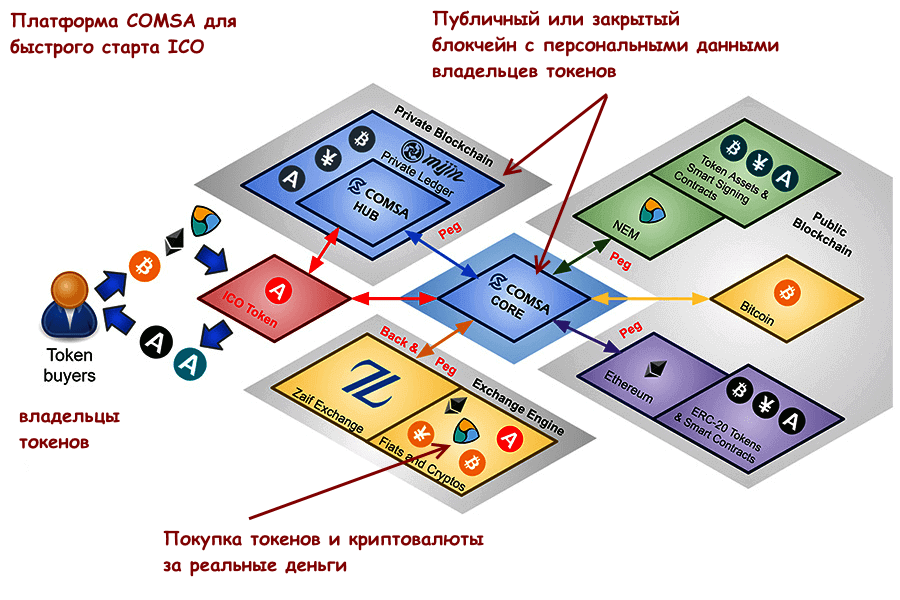

Ownership rights and buy/sell operations of ordinary shares are recorded in a registry, which is guaranteed correct by independent organizations (depositories). Simply put — this means that there is personal responsibility for the correctness of data in the registry. In the case of tokens, this is not the case; all data are stored only in the project’s local blockchain. An example of how this can look is shown below:

Like all securities, electronic rights can be converted into real money (even in rubles). The three most popular ways:

- Reverse sale. ICO, like the “classic” pre-IPO placement, involves a pre-sale of shares at a reduced price among a limited circle of investors (presale). When the project officially enters the fundraising stage, the price can start to grow, and then you can sell with profit. Successful projects also periodically buy back their rights to reduce dividend payouts.

- Passive income from ownership. The more successful the project, the more profitable the tokens, especially since they should accrue interest — this process is no different from bank deposits (theoretically).

- Trading profits. Tokens can be traded on exchanges — their prices can go up or down, allowing a crypto trader to earn always. Profits can be much higher than buybacks and dividends. But the risk of losses is significantly higher.

Problems and future of tokens

Let’s start with the advantages:

- You can quickly raise the required amount for developing a new project. Truly profitable projects (in the future, of course!) are too risky for banks and large investors, who are generally not ready for this. Think of PayPal, which became one of the largest non-bank payment systems thanks to independent investor Peter Thiel, who invested his money when the market was empty and there were no benchmarks for profitability.

- The main feature that distinguishes tokens from other investment projects is that the “owners” of the project or cryptocurrency have full control over their business, unlike bank or venture financing. Large investors are rarely interested in developing the idea; they are more concerned with bringing it to an attractive market value and then selling the company from that sector.

Now about the problems that exist in any sphere:

- Ownership rights are stored in a private blockchain

For “beginners,” the idea of an immutable storage looks good. But — only at first glance. The dangerous idea is that if someone forges the sequence of transactions (blocks), then from a legal standpoint — and since blockchain is declared as a replacement for paper documents — everything will look “fine.” Blockchains work well when dealing with monetary calculations, they keep growing, and attackers cannot keep up.

But what about ownership registries? It’s quite possible to create (mine) the required number of unique blocks and then change them in the database as owners see fit. Only a specialist can distinguish real information from fake. Now the US Securities and Exchange Commission (SEC) has a clear stance — requiring registration of digital share issuance just like with traditional ones. Then their inspectors will have access to the database, and a copy of ownership rights will be stored on SEC servers.

- Expecting tokens to constantly increase in price

This is a natural desire, not only for residents of the former USSR — everyone wants stable passive income. Banks and stock traders also know this, so they constantly generate and support hype demand. Again, it’s worth noting that, in essence, they do not care where the price moves — they profit from the movement, not the quote. A sharp rise can also be disadvantageous for an ICO project — constant investor and trader scrutiny of “how Bitcoin is doing” and related reactions can seriously worsen the situation for a company that invested investors’ funds into real sectors of the economy.

And what is the result?

Despite many ICO projects that failed to meet their declared potential or turned out to be outright scams, it can be said that tokens in cryptocurrencies gave the global economy a new impetus for development. The digital economy continues to grow and brings good income to investors.